Why Live Commerce in the Gulf Will Be an $85 Billion Market by 2035

Live commerce is about to become the Gulf’s next multi-billion-dollar retail revolution.

The Gulf is about to experience one of the fastest shopping transformations in history.

While most people are busy talking about fintech breakthroughs or the latest AI developments, something profound is happening in how consumers actually buy things. Something that will reshape the entire retail landscape of the region.

Live commerce is coming to the GCC. And when I say it’s going to be huge, I mean we’re looking at a complete reimagining of how commerce works in one of the world’s wealthiest regions.

Let me walk you through exactly why this matters, what’s driving it, and why the timing is absolutely perfect.

What Is Live Commerce, Really?

Picture this. You’re scrolling through Instagram on a Thursday evening. You follow a beauty creator you trust. She goes live. You tap to watch.

She’s not just posting a photo of a new skincare product. She’s using it right there on camera. Showing you the texture. Explaining why she loves it. Answering questions from viewers in real time. Someone asks if it works for sensitive skin. She responds immediately.

You watch for three minutes. You’re completely convinced. You don’t need to read reviews. You don’t need to visit five different websites. You just click the buy button right there in the stream.

The product arrives at your door two days later.

That entire journey, from discovery to purchase, happened in a single three-minute live stream. No friction. No second-guessing. Just pure, immediate conversion.

That’s live commerce.

It’s shopping blended with entertainment, social interaction, and instant gratification. It’s not a new channel. It’s a completely different way of thinking about retail.

And it’s already massive in other parts of the world. The Gulf is just getting started.

Understanding the Gulf Consumer Mindset

Before we dive into market size and projections, you need to understand something fundamental about how people in the Gulf think about commerce and ownership.

There’s a deep cultural preference here that shapes everything. People in the GCC want to own things, not rent them. They want control, not dependency.

Look at how people live. They buy homes instead of renting apartments. They purchase cars outright instead of leasing or relying on rideshare apps. They build their own businesses instead of climbing corporate ladders in multinational companies.

This isn’t just about wealth, although the region certainly has that. It’s about psychology. It’s about autonomy and independence being core values.

Now think about what this means for e-commerce.

Gulf merchants don’t want to be just another faceless vendor on Amazon or Noon. They don’t want to follow someone else’s rules. They don’t want to pay 15% to 30% commission to a marketplace that controls the customer relationship.

They want to own their storefront. Build their own brand. Keep their customer data. Control their margins. Make their own decisions.

That’s exactly why platforms like Salla and Zid absolutely exploded in popularity across the region. These weren’t just Shopify clones translated into Arabic. They were purpose-built for merchants who wanted full independence and control.

Salla launched in 2016. Within a few years, it became the dominant e-commerce platform in Saudi Arabia, surpassing even Shopify’s presence in the region.

Why? Because they aligned perfectly with this cultural preference for self-sovereign commerce.

The Three Waves of Gulf E-Commerce

To understand where we’re going, you need to understand where we’ve been.

Wave One was the Marketplace Era, roughly 2010 to 2020.

This was when big platforms like Noon, Namshi, and Talabat dominated everything. These were essentially the Amazon model transplanted to the Gulf. Centralized control. Merchants had almost no power. Consumers had limited direct relationships with sellers.

These platforms served an important purpose. They introduced millions of Gulf consumers to online shopping. They built logistics infrastructure. They solved payment challenges.

But they also created dependency. Merchants were just vendors on someone else’s platform. This worked fine in the early days when e-commerce was new and scary. But as merchants got more sophisticated, they wanted more.

This wave reached maturity by 2020. These platforms are still growing, but the explosive growth phase is over. They’re now established incumbents.

Wave Two was Merchant Independence, from about 2018 to 2024.

Salla and Zid gave merchants something revolutionary. The ability to launch a fully branded online store in hours. No technical knowledge required. No expensive developers. Just a simple platform that let anyone become an independent e-commerce merchant.

Suddenly, a small perfume shop in Riyadh could have a beautiful online store with payment processing, inventory management, and shipping integration. A jewelry designer in Dubai could sell directly to customers across the entire GCC without paying marketplace commissions.

Merchants owned their customer data. They controlled their pricing. They built their brand equity. They answered to no one.

This wave is still growing strongly, especially in smaller cities and among new merchants. But in major urban centers, it’s approaching maturity. Most merchants who want an online store already have one.

Wave Three is Live Commerce, and we’re at the very beginning of it right now.

This is creators and merchants selling products in real-time video streams. Direct interaction with customers. Instant purchases. Entertainment value baked into the shopping experience.

We’re talking about a fundamental shift in how products are discovered, evaluated, and purchased. And based on what’s happened in every other major market that’s adopted live commerce, this wave is going to be absolutely massive.

Why Gulf Consumers Are Uniquely Ready for Live Commerce

Young people in the Gulf, particularly Gen Z and younger millennials, behave very differently from Western shoppers. Understanding these behavioral patterns is crucial to understanding why live commerce will explode here.

They’ve Completely Stopped Reading Product Descriptions

This generation doesn’t read anymore. Not really. They don’t carefully compare product specifications across five different tabs. They don’t read through detailed reviews on multiple websites.

Instead, they watch videos. They scroll through TikTok. They consume Instagram Reels. They want to see products in action, not read about them.

Think about how different this is from traditional e-commerce. The entire online shopping experience was built around text. Product titles. Bullet points of features. Long descriptions. Customer review paragraphs.

But when you watch a creator use a product live, you learn more in 60 seconds than you would from reading a thousand words. You see the texture. You hear their genuine reaction. You watch it being used in real scenarios.

This isn’t laziness. It’s efficiency. Video conveys information faster and more convincingly than text ever could.

Influencer Trust Is Extraordinarily High

In Western markets, there’s often skepticism around influencer marketing. People assume creators are just reading scripts written by brands. Trust is fragile.

The Gulf is different. Influencer trust here is extraordinarily high, especially among younger audiences. When a respected creator recommends something, people genuinely believe them.

This isn’t blind faith. It’s because the relationship between creators and their audiences here tends to be more authentic and interactive. Creators respond to comments. They go live regularly. They share their actual lives, not just polished content.

When a trusted creator goes live and shows a product they genuinely love, viewers don’t just watch. They buy. Not tomorrow. Not after doing research. Right now, in the moment.

This immediate trust and conversion is exactly what makes live commerce so powerful. The purchase decision happens in seconds, not days.

Video Consumption Is Off the Charts

Here’s a fact that tells you everything. The GCC has the highest social media usage per capita in the entire world. Not just high. The highest.

TikTok penetration in Saudi Arabia and UAE is among the highest globally. Instagram is absolutely dominant. Snapchat has massive reach, especially among younger users. YouTube Shorts is exploding.

People here spend hours every day consuming short-form video content. They’re not passively watching. They’re actively engaged, commenting, sharing, participating.

This creates the perfect environment for live commerce. The behavior is already there. The attention is already captured. The platforms are already installed on everyone’s phones.

The only missing piece is the ability to buy products directly within these video experiences. And that piece is being built right now.

Mobile Commerce is Second Nature

In many markets, there’s still friction between browsing on mobile and actually completing a purchase. People look on their phones but switch to desktop to buy.

Not in the Gulf. Mobile commerce conversion rates here are the highest in the world. People discover products on mobile, evaluate them on mobile, purchase them on mobile, and track delivery on mobile. The entire journey happens on a phone.

This matters enormously for live commerce because live streams are inherently mobile experiences. People don’t watch live content on their laptops. They watch on their phones while commuting, relaxing at home, or during breaks.

When purchasing can happen with a single tap without ever leaving the stream, conversion rates skyrocket. And Gulf consumers are already completely comfortable with this behavior.

The Market Size Numbers Tell a Compelling Story

Let me walk you through the actual market opportunity here, because the numbers are striking.

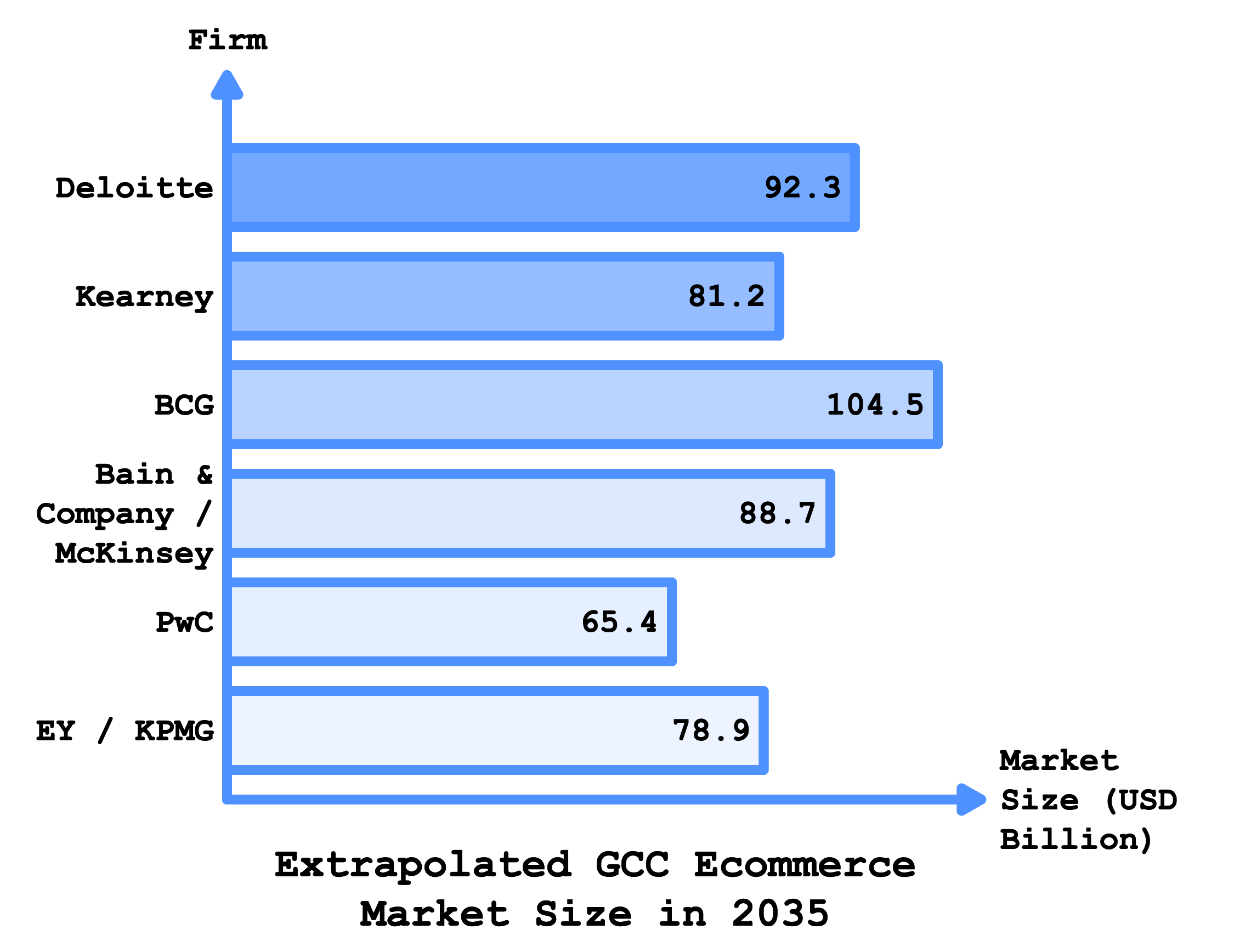

I built a comprehensive forecast by analyzing projections from every major consulting firm that covers the GCC region. I’m talking about Deloitte, Kearney, BCG, PwC, EY, KPMG, Bain, and McKinsey. Each firm published their own projections for where GCC e-commerce is heading over the next decade.

Deloitte’s most recent analysis projects the market reaching around 92.3 billion dollars by 2035. They’re quite bullish on the region’s digital transformation.

Kearney is slightly more conservative, landing at about 81.2 billion. They factor in potential economic headwinds and slower adoption in smaller markets.

BCG takes the most aggressive stance at 104.5 billion. They see accelerated growth driven by young demographics and high smartphone penetration.

Bain and McKinsey jointly project around 88.7 billion, sitting comfortably in the middle of the range.

PwC is the most conservative at 65.4 billion. They account for potential market saturation in major cities.

EY and KPMG come in at about 78.9 billion, taking a measured approach based on current growth trajectories.

When you blend all these projections together and average them out, you land at 85.17 billion dollars.

That’s the total addressable market for e-commerce in the GCC by 2035. Everything from fashion to electronics to groceries to furniture. The entire digital commerce ecosystem.

Now here’s where it gets really interesting. Because live commerce isn’t going to be a tiny slice of this pie. Based on what’s happened everywhere else in the world, it’s going to capture a significant portion of total e-commerce.

What Actually Happened in Every Other Major Market

Live commerce isn’t theoretical. It’s not some futuristic concept. It’s already massive in multiple countries around the world. We have real data on exactly what happens when it takes off.

Let me walk you through each major market because the patterns are remarkably consistent and absolutely fascinating.

China Created the Entire Category

China didn’t just adopt live commerce. They invented it. Taobao Live launched in 2016, essentially creating the modern live shopping format. Douyin, which is the Chinese version of TikTok, quickly followed with their own live shopping features.

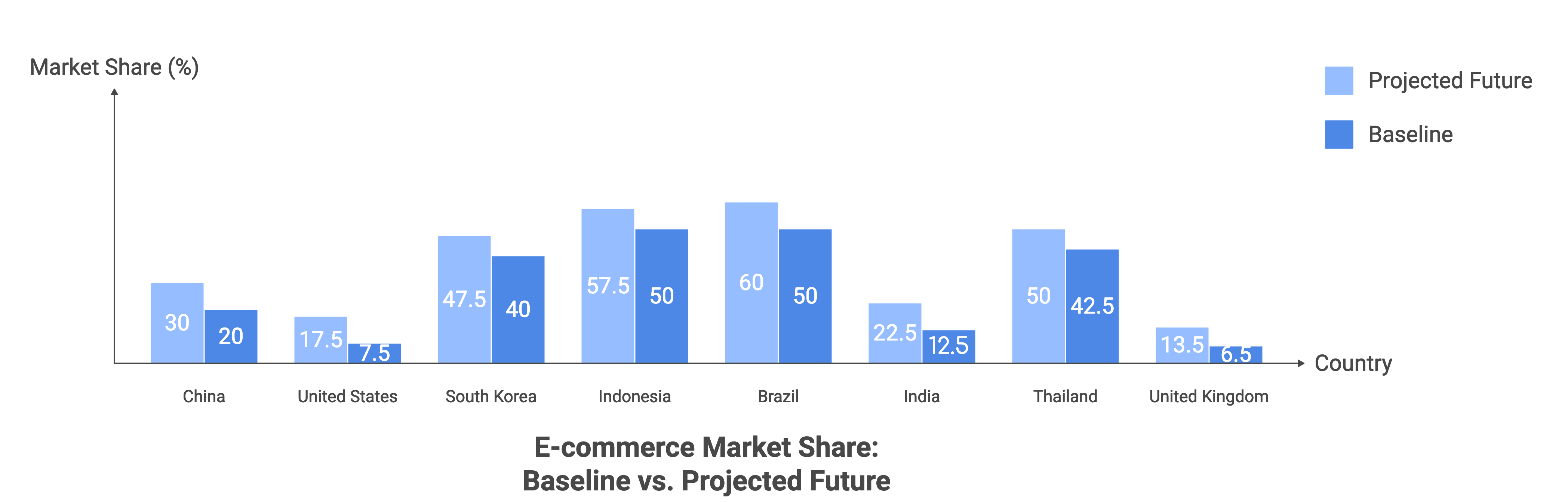

Today, somewhere between 20% and 35% of all e-commerce transactions in China happen through live video streams. Let that sink in. Nearly a third of all online shopping in the world’s largest e-commerce market happens via live streams.

We’re talking about over 400 billion dollars in annual gross merchandise value flowing through live commerce. That’s larger than the entire e-commerce market of most countries.

The Chinese model proved something crucial. Live commerce isn’t a novelty. It’s not a passing trend. It’s a fundamental improvement in how products are sold online. It combines entertainment, education, social proof, and instant gratification in a way that traditional e-commerce simply cannot match.

Top Chinese live commerce hosts have become massive celebrities. Someone like Viya or Li Jiaqi can sell hundreds of millions of dollars worth of products in a single live stream. Their influence rivals traditional entertainment stars.

Indonesia Adopted Even Faster Than China

If China proved the model works, Indonesia proved it can scale incredibly fast in the right environment.

Indonesia went from essentially zero live commerce penetration to 50% or even 60% of all e-commerce flowing through live streams. And this happened in roughly three years.

Shopee Live and TikTok Shop drove most of this growth. They made it incredibly easy for small merchants and individual creators to start selling via live streams. No special equipment needed. Just a smartphone and products to sell.

What’s particularly relevant for the Gulf is that Indonesia’s adoption was driven by similar factors. High mobile penetration. Strong social media usage. A young, video-native population. And a merchant base looking for new ways to reach customers.

The Indonesian trajectory suggests that once live commerce infrastructure is in place, adoption can happen shockingly fast. Faster than anyone expects.

South Korea Became the Fashion and Beauty Capital

South Korea took a different approach. Rather than mass-market everything, they focused heavily on fashion and beauty categories. And they absolutely dominated.

Between 40% and 50% of all online fashion and beauty purchases in Korea now happen through live commerce. Platforms like Grip, Naver Shopping Live, and others have become the default way people discover and buy fashion products.

Korean live commerce streams feel like fashion shows mixed with shopping networks mixed with social media. High production value. Professional hosts. But also real-time interaction and immediate purchasing.

The Korean model demonstrates that live commerce can work incredibly well for premium and aspirational products, not just mass-market goods. This matters for the Gulf because luxury, fashion, and beauty are enormous categories here.

Brazil Showed It Works in Latin America Too

For a while, skeptics argued that live commerce was just an Asian phenomenon. Cultural factors. Different shopping behaviors. It wouldn’t translate elsewhere.

Brazil proved them wrong.

Brazilian creators on Instagram and TikTok now influence around 50% of all e-commerce purchases in the country. Even when the final transaction doesn’t happen in-stream, the discovery and persuasion happens through live content.

Brazilian consumers behave remarkably similarly to Asian consumers when it comes to creator trust and video consumption. And the Gulf has even stronger creator culture and higher mobile usage than Brazil does.

India Is Where the Gulf Is Today

India is perhaps the most relevant comparison for the Gulf right now because they’re at a similar stage of adoption.

India currently sits at around 10% to 15% live commerce penetration. But they’re scaling incredibly rapidly toward 20% to 25% penetration within the next few years.

Indian platforms like Meesho, Flipkart, and others are investing heavily in live commerce infrastructure. Every major player recognizes this is where the market is heading.

The Indian market shows us what early-stage growth looks like. Infrastructure being built. Early adopters proving the model. Mainstream consumers starting to pay attention.

This is roughly where the Gulf sits right now. On the cusp of exponential growth.

The West Is Slower But Still Moving in the Same Direction

The United States currently sits at around 5% to 10% live commerce penetration. Projections suggest they’ll reach 15% to 20% over the next several years.

The UK is similar, currently between 5% and 8%, likely moving toward 12% to 15%.

Western adoption is slower for several reasons. Stronger traditional retail infrastructure. Different social media consumption patterns. More skepticism around influencer marketing. Higher privacy concerns.

But even with all these headwinds, live commerce is still growing in the West. Because fundamentally, it’s a better shopping experience for certain product categories.

The key insight here is that the Gulf will not follow the Western adoption curve. Gulf consumer behavior looks far more like Asia than it looks like America or Europe.

The Global Pattern Is Crystal Clear

When you average adoption rates across all major markets worldwide, live commerce is trending toward representing about 35.9% of total e-commerce by 2030.

Some markets will be higher. China and Indonesia are already well above this. Some will be lower. The West will likely stay below this benchmark for years.

The Gulf will almost certainly land somewhere between 25% and 35% penetration by 2035. Maybe higher if adoption follows the Indonesian speed curve.

Why am I confident about this? Because every single factor that drove adoption elsewhere exists in the Gulf in even stronger form. Higher income. More mobile usage. Stronger creator culture. Younger demographics.

The Gulf Live Commerce TAM Is Staggering

Now let’s do the math on what this actually means for market size.

We established that total GCC e-commerce will reach 85.17 billion dollars by 2035. That’s the blended forecast from all major consulting firms.

Now let’s apply different live commerce penetration scenarios.

In a conservative case where live commerce captures just 25% of total e-commerce, you’re looking at 21.3 billion dollars in live commerce gross merchandise value. That’s roughly the size of the entire GCC e-commerce market back in 2023.

In a moderate case with 30% penetration, which frankly seems quite reasonable given global benchmarks, the market reaches 25.5 billion dollars.

In an aggressive but not unrealistic case where the Gulf follows the global average of 35.9% penetration, you’re looking at 30.6 billion dollars in live commerce.

Even in the most conservative scenario, live commerce becomes a 21 billion dollar market in the Gulf within a decade. That’s not a niche. That’s a fundamental shift in how commerce works in the region.

Think about what this means practically. Twenty to thirty billion dollars in annual transaction value flowing through live video streams. Thousands of creators earning income from live selling. Millions of consumers discovering and purchasing products through live content.

This isn’t some distant future possibility. This is what the next decade looks like based on proven adoption patterns from every other major market.

Almost No Capital Has Been Deployed Yet

Here’s what makes this opportunity so striking from an investment perspective.

As of right now, only about 5 million dollars in venture capital has been deployed into GCC live commerce startups. Total. Across all companies.

That includes early platforms like Siin, which is building live shopping infrastructure. It includes a handful of other small startups experimenting in the space.

Five million dollars. For a market that’s going to be 20 to 30 billion dollars within a decade.

Let me give you some context on how absurdly early this is.

In China between 2016 and 2019, before live commerce even hit mainstream adoption, over one billion dollars had already been deployed into live commerce startups and infrastructure. Investors recognized the trend early and funded aggressively.

In Indonesia between 2020 and 2022, TikTok Shop alone attracted around 800 million dollars in venture funding. That’s one company in one market in two years.

The Gulf has received 5 million total.

Now, funding will absolutely increase. As more companies launch and prove traction, capital will flow in. I project that we’ll see somewhere between 30 and 50 million dollars deployed over the next five to seven years as the category starts proving itself.

By 2035, once live commerce is established and mature, total venture deployment across the category will likely cross 100 to 200 million dollars.

But right now? Right now we’re at Day Zero. The infrastructure is just starting to be built. The first real companies are just launching. The capital is still sitting on the sidelines.

This is what frontier markets look like before they explode. This is what China looked like in 2015. What Indonesia looked like in 2019.

The opportunity is completely wide open.

Why the Gulf Has Unfair Structural Advantages

The GCC isn’t just another emerging market. It has specific structural advantages that will accelerate live commerce adoption faster than almost anywhere else.

Wealthiest Consumers in the World

Let’s start with the obvious one. The Gulf is incredibly wealthy. We’re talking about Saudi Arabia, UAE, Qatar, and Kuwait. These are some of the highest GDP per capita countries on Earth.

This means discretionary spending is extraordinarily high. People here don’t just buy necessities. They buy premium products. They buy often. They buy impulsively.

When a creator goes live showing a luxury watch or designer handbag or premium skincare product, Gulf audiences can actually afford to buy it right then and there. There’s no “add to wishlist for later.” It’s immediate conversion.

This wealth factor is why average order values in Gulf live commerce will likely be significantly higher than global averages. The market isn’t just big in volume. It’s big in value.

Highest Social Media Usage on the Planet

I mentioned this earlier but it’s worth emphasizing again. GCC residents spend more time on social media than any other region in the world. Not in the top five. Not in the top three. Number one globally.

TikTok, Instagram, Snapchat, YouTube. These platforms are woven into daily life here in a way that exceeds even developed markets like the US or UK.

The average Gulf consumer is already spending several hours per day consuming video content from creators they follow. The behavior is already there. The attention is already captured. The platforms are already installed on everyone’s phones.

Live commerce doesn’t need to change behavior. It just needs to add a buy button to behavior that already exists.

Mobile Commerce Is Completely Natural

Gulf consumers have the highest mobile-to-purchase conversion rates in the world. There’s almost no friction between discovering a product on mobile and completing the purchase.

In many markets, people still browse on mobile but switch to desktop to actually buy. Not here. The entire shopping journey happens on a phone. Discovery, evaluation, purchase, tracking, customer service. All mobile.

This is absolutely critical for live commerce because live streams are inherently mobile experiences. People watch live content on their phones while commuting, relaxing at home, or during breaks at work.

When purchasing happens with a single tap without ever leaving the stream, conversion rates go through the roof. And Gulf consumers are already completely comfortable with this behavior.

There’s no adoption curve needed. The behavior already exists. It just needs to be channeled into live commerce experiences.

Creator Culture Is Incredibly Strong

The influencer economy in the Gulf is massive and sophisticated. Creators here monetize their audiences aggressively and audiences genuinely trust their recommendations.

Unlike some markets where influencer marketing feels forced or artificial, creator-audience relationships in the Gulf tend to be authentic and interactive. Creators respond to comments. They go live regularly. They share their actual lives.

This creates perfect conditions for live commerce. When a creator goes live to sell products, it doesn’t feel like an ad. It feels like getting a recommendation from someone you trust.

Add to this the fact that Gulf creators are often early adopters of new platform features and monetization tools. They’re hungry for new ways to earn income from their audiences. Live commerce gives them exactly that.

Cultural Fit for Social Shopping

Shopping in the Gulf has always been a social experience. Going to malls isn’t just about buying things. It’s about spending time with friends and family. It’s entertainment as much as commerce.

Live commerce captures this same social dynamic in a digital format. You’re not just buying a product. You’re participating in a live event. Chatting with other viewers. Asking questions. Getting recommendations.

The format fits perfectly with existing cultural preferences around social shopping experiences. It’s not asking people to adopt a foreign behavior. It’s translating a behavior they already love into a digital context.

What the Gulf Version Will Actually Look Like

The region won’t simply copy Chinese models or American platforms. The Gulf will build native platforms tailored specifically for Arabic-speaking creators and GCC consumer behavior.

Based on what’s working in other markets and what makes sense for the region, here’s what I expect to emerge over the next several years.

A Luxury Collectibles Platform

Think of Whatnot, the American platform for collectibles, but focused on luxury goods that matter in the Gulf. Watches, sneakers, handbags, rare items.

Verified sellers going live to auction off or sell high-end products. Real-time bidding. Authentication guarantees. Community of collectors.

The Gulf has massive appetite for luxury collectibles. Watches alone are a huge category. Designer sneakers have enormous following. Limited edition products create urgency and excitement.

A platform that combines the excitement of live auctions with the trust of verified luxury items could become massive very quickly.

A Mass Market Live Commerce Platform

This would be the Gulf equivalent of Taobao Live. A platform where thousands of small merchants can easily go live to sell their products.

Critically, this needs to integrate seamlessly with existing merchant platforms like Salla and Zid. Merchants shouldn’t need to rebuild their entire infrastructure. They should just add live streaming capability to stores they already operate.

Imagine a small clothing boutique in Riyadh. They already have a Salla store. Now they can simply hit “Go Live” and start showing products to their existing customer base, while also reaching new audiences who discover them through the live feed.

This democratization of live commerce, making it accessible to every merchant regardless of size, is what will drive mass adoption.

An Arabic-Native Social Commerce Platform

TikTok Shop is starting to test in some GCC markets, but there’s room for a platform built natively for the region from day one.

Not just translated content. But platform mechanics, discovery algorithms, creator incentives, and cultural norms all designed specifically for Arabic-speaking creators and Gulf audiences.

This platform would integrate deeply with local payment rails. Partner with regional logistics providers. Understand cultural considerations around product categories and content moderation.

The advantage of being native rather than adapted cannot be overstated. Local platforms consistently outperform global platforms that are simply translated and localized.

A Live Fashion and Beauty Platform

Fashion and beauty are absolutely enormous categories in the Gulf. The region has some of the highest per capita spending on these categories globally.

A dedicated platform for fashion brands and beauty creators to stream runway shows, styling sessions, product launches, and exclusive drops would capture massive value.

Partner with regional influencers who already have millions of followers. Give them professional tools to create engaging live shopping experiences. Integrate with existing brand e-commerce infrastructure.

Korean platforms like Grip have shown that fashion-focused live commerce can sustain massive valuations and transaction volumes. The Gulf has even higher spending in these categories.

Merchant Tools and Infrastructure

Beyond consumer-facing platforms, there’s huge opportunity in B2B tools that enable live commerce.

Software that turns any existing Salla or Zeed store into a live-enabled storefront. Think of it as Shopify meets StreamYard meets live commerce management.

This would include streaming infrastructure, product catalog integration, real-time inventory management, checkout flow optimization, analytics and performance tracking, and multi-platform streaming capability.

Merchants need tools that are simple enough for non-technical users but powerful enough to drive serious revenue. The company that builds the picks and shovels for Gulf live commerce will be enormously valuable.

Why This Matters Right Now

The infrastructure is ready. The capital is available. The consumer behavior is there. Everything is aligned for explosive growth.

Salla, Zeed, and Zid already proved that Gulf merchants want independence and control. They built the first layer of infrastructure. Now that infrastructure needs a live commerce layer on top.

TikTok, Instagram, and Snapchat already dominate attention and screen time. They’ve trained an entire generation to consume video content and trust creator recommendations. The behavior is completely normalized.

Payment systems have matured significantly over the past five years. Checkout flows are smooth. Fraud prevention is sophisticated. Logistics networks can deliver quickly across the region.

The only missing piece is the live commerce layer itself. And that’s being built right now by early startups and platform features.

Timing in venture capital is everything. Too early and you burn cash waiting for the market to develop. Too late and you miss the exponential growth phase.

Right now, Gulf live commerce is at the perfect moment. Infrastructure exists. Consumer behavior is ready. But the category is still nascent enough that early movers can capture disproportionate value.

The Pattern Recognition Is Undeniable

Every major market that introduced live commerce infrastructure saw explosive growth. The patterns are remarkably consistent across geographies.

China went from zero to over 400 billion dollars in annual live commerce GMV in roughly five years.

Indonesia hit over 50% e-commerce penetration for live commerce in about three years.

South Korea captured 40% to 50% of fashion and beauty e-commerce through live streams.

Brazil saw 50% of purchases influenced by live creator content within a few years of serious adoption.

India is scaling rapidly toward 20% to 25% penetration right now.

Even the slower Western markets are moving steadily toward 15% to 20% penetration.

The pattern is clear. Once live commerce infrastructure reaches a certain threshold, adoption accelerates rapidly. Consumer behavior shifts fast. Merchants pile in because conversion rates are dramatically better than traditional e-commerce.

The Gulf has better fundamentals than most of these markets had when they started their growth curves.

Higher income means higher purchasing power and less price sensitivity.

More mobile adoption means smoother user experiences and higher conversion.

Stronger creator culture means more authentic content and higher trust.

Younger demographics mean more openness to new shopping formats.

The only question is timing. And based on infrastructure development and early traction, the timing is right now.

For Investors and Builders

The GCC live commerce market will grow into a 20 to 30 billion dollar category by 2035. That’s a conservative projection. It could easily be larger if adoption follows the Indonesian or Chinese pace rather than a more measured trajectory.

Right now, only 5 million dollars has been deployed across the entire category. The infrastructure is still being built. The first real platforms are just launching.

This is the definition of a frontier market opportunity. All the ingredients are in place. Consumer behavior is ready. Technology infrastructure exists. Economic fundamentals are strong.

What’s missing is execution. Someone needs to build the platforms. Someone needs to educate merchants. Someone needs to activate creators. Someone needs to create the user experiences that make live shopping feel natural and exciting.

This is what it looked like to invest in Chinese e-commerce infrastructure in 2015 and 2016. What it looked like to back Southeast Asian platforms in 2018 and 2019. What it looked like to build in India in 2020 and 2021.

The frontier is wide open. The opportunity is massive. And the timing is perfect.

Great read!

I spent many months on this problem, and here was my conclusion. Live shopping has an insanely difficult cold start problem. A normal marketplace has the luxury of connecting buyer and seller async - even if it takes weeks. A live shopping marketplace must make buyer and seller meet and transact AT THE EXACT TIME.

Hence, we need a platform with an inbuilt captive audience to solve this.

Option 1 is a large horizontal (noon) or vertical (namshi) adds live to their platform and hopes that a small % of their audience converts to watching the livestream. Sadly, whenever the e-commerce majors try live, they make it dead boring and recreate TVC (see Amazon live in the US). What would kill is an exploding clearance sale on a highly-produced set that almost feels like a game show.

The other way to make it work is TikTok doing it. Again similar theory, large captive audience, already watching livestreams, will convert.

I’m very bearish on an independent platform solving live shopping in the region because we don’t have a base marketplace to build on top off. Whatnot was built on the backs of eBay power sellers and collectibles - two giant microcosms which could kickstart marketplace mechanics. Nothing like that exists here - neither a large enough niche or a base platform to pull sellers from. Instagram/Dubizzle power sellers don’t have enough interesting inventory to create shows, neither do they want to formalize operations and get tax compliant. Cars might be an interesting category since offline auctions are already huge, but then that’s a touch and feel category, probably won’t work over video.

Live infra plays on Salla or Zid are DOA too, it’s impossibly hard to pull people on to a standalone website and then fiddle with what is likely a low grade media player when the gold standard is Instagram Live.

I think the space is very exciting and the formats that you could invent are endless but my bet is it will be solved inside one of the majors. If anyone wants to take a crack at it, the formula seems to be = unique inventory (either product or price) + selling format that’s default entertaining and takes the seller out of the equation (30s auctions, exploding sales) + existing captive audience.