This One Fundraising Sentence Makes Investors Instantly Pass!

A practical guide to VC ownership targets, cap table strategy, dilution math, and fundraising tactics that serious investors actually respond to

A lot of founders come to investors and say some version of this:

“We’re closing the round next Friday. There’s maybe $250K left at the $15M valuation, then we’re bumping the cap.”

It sounds smart. It sounds urgent. It sounds like classic FOMO tactics that should push investors to move faster.

But here’s the thing: for good VCs, this line doesn’t create urgency. It creates a reason to pass.

Let me show you why.

Let’s Do the Math VCs Are Actually Running

Most founders pitch scarcity like this creates decision pressure. But when a sophisticated investor hears “only $250K left,” they’re not thinking about FOMO. They’re running a completely different calculation.

The Founder’s Mental Model

You’re thinking: If I let them in for $250K at $15M, and we exit at $200M, that’s a massive win for them.

The math:

Investment: $250,000

Valuation: $15,000,000

Ownership: 1.67%

Exit value: $200,000,000

Their return: $200M × 1.67% = $3,340,000

That’s 13.4× their money. Any rational investor should jump at this, right?

Wrong.

The VC’s Mental Model

Here’s what the partner is actually calculating when you say “$250K left”:

Let’s say they’re investing out of a $60M fund. That fund probably has:

30-35 companies in the portfolio

A 10-year lifecycle to return the fund

2.5-3× target return to LPs (so they need to turn $60M into $150-180M)

Now let’s see what your “$250K allocation” actually means to their fund performance:

Scenario 1: You’re a solid outcome

Exit at $200M

Their $250K becomes $3.34M

As a % of their fund: 5.6% return contribution

Scenario 2: You’re a great outcome

Exit at $500M

Their $250K becomes $8.35M

As a % of their fund: 13.9% return contribution

Scenario 3: You’re a unicorn

Exit at $1B

Their $250K becomes $16.7M

As a % of their fund: 27.8% return contribution

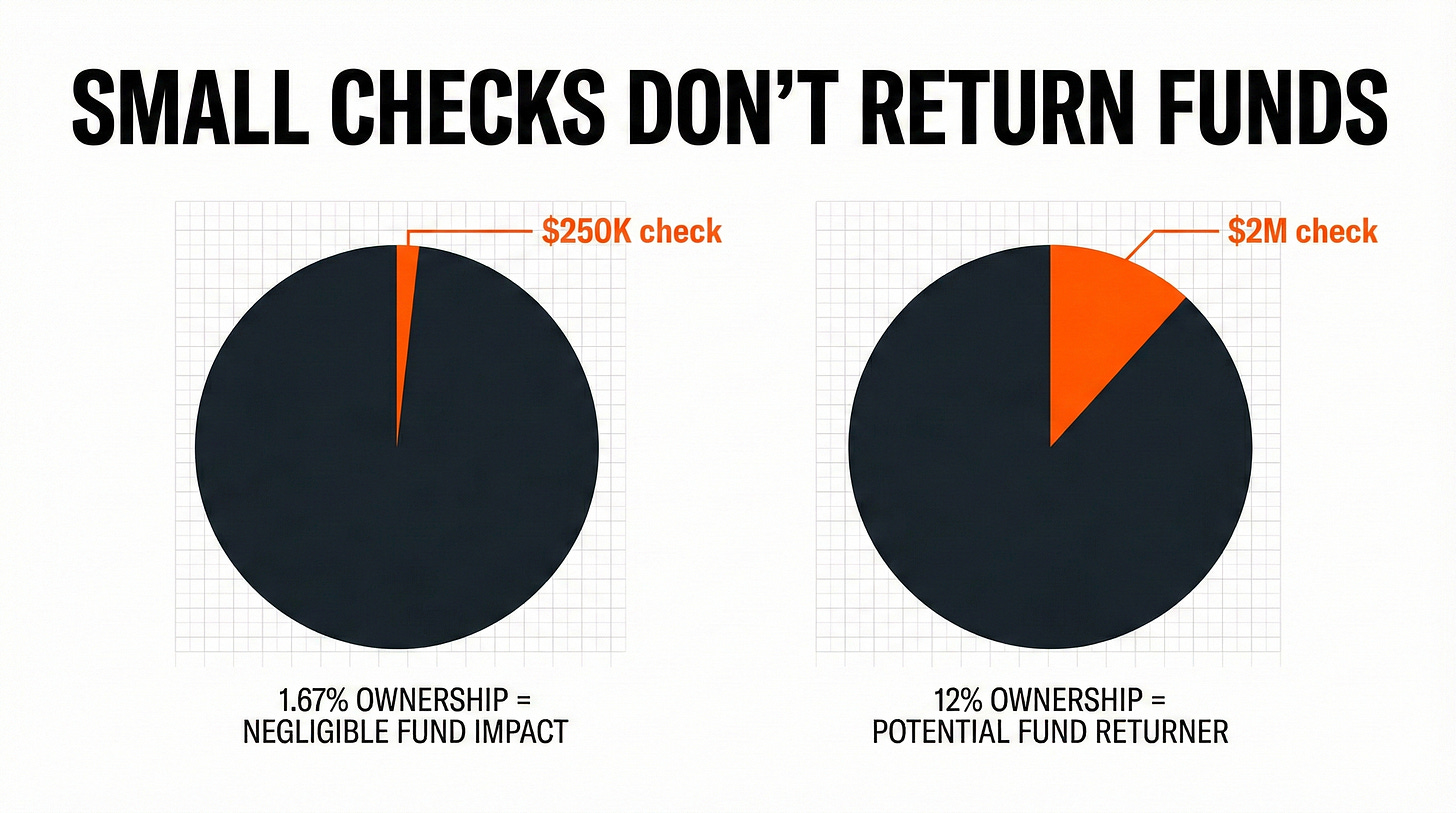

Here’s the problem: Even in the unicorn scenario, at 1.67% ownership, you’re not a fund-returner. You’re a nice win, but you’re not the investment that defines their vintage.

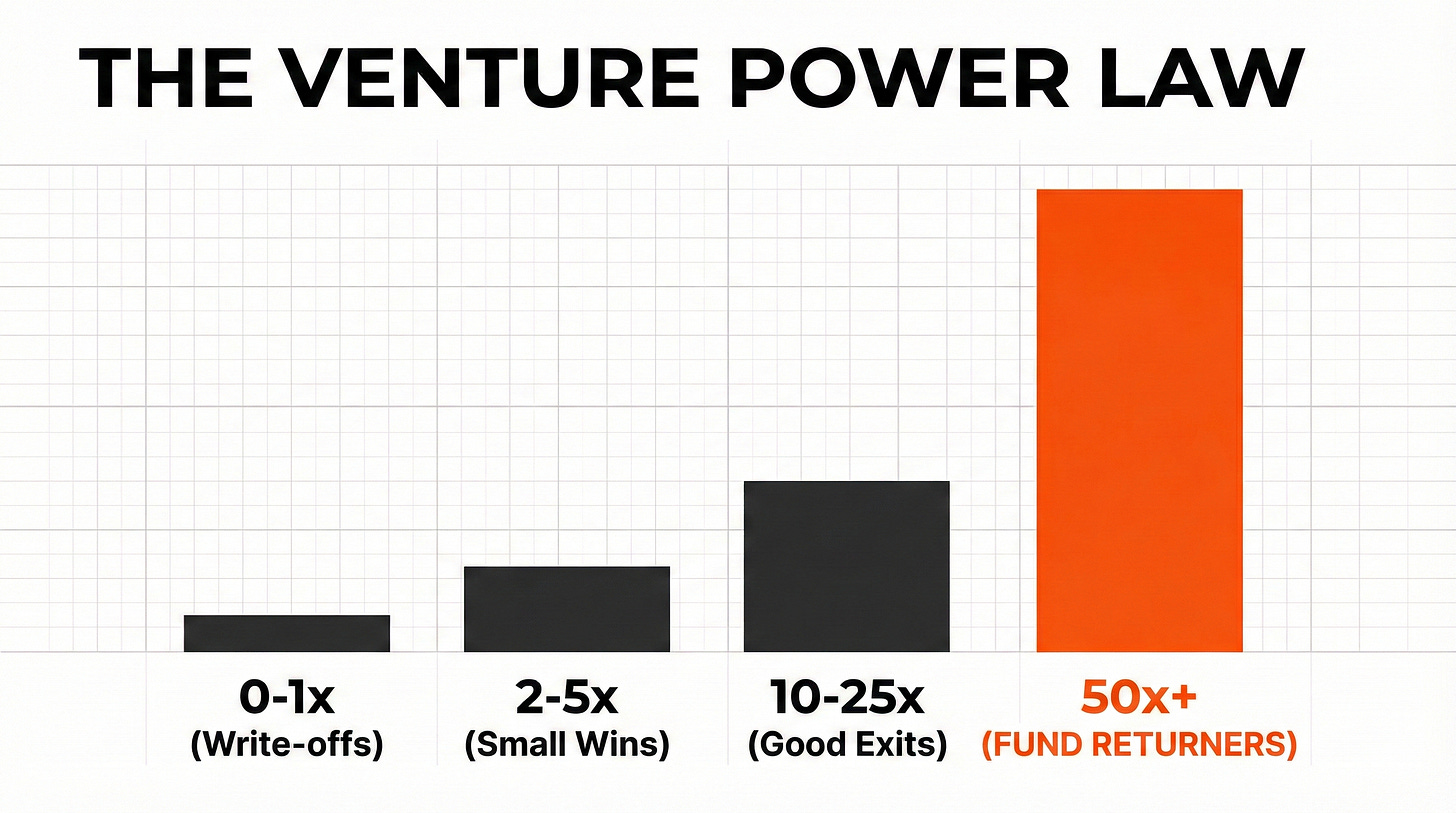

And venture capital is a power law game. The math looks like this across a typical fund:

60-70% of investments return 0-1×

20-25% return 2-5×

5-10% return 10-25×

1-3% return 50×+

The entire fund’s returns come from those last few companies. So when VCs evaluate your round, they’re asking:

“If this is one of our 2-3 mega-winners, will our ownership position actually matter?”

At 1.67%? The answer is no.

The Ownership Threshold That Actually Matters

Let’s run the same scenarios with meaningful ownership. Say a VC writes a $2M check at $15M pre-money (11.8% ownership):

Scenario 1: Solid exit at $200M

Return: $200M × 11.8% = $23.6M

Fund impact: 39.3% of fund returned

Scenario 2: Great exit at $500M

Return: $500M × 11.8% = $59M

Fund impact: 98.3% of fund returned (essentially returns the entire fund)

Scenario 3: Unicorn at $1B

Return: $1B × 11.8% = $118M

Fund impact: 196.7% of fund returned (nearly 2× the fund from one investment)

Now we’re talking. At this ownership level, even the “solid” outcome moves the needle significantly. The great outcome returns their fund. The unicorn outcome makes their career.

This is why the best VCs obsess over ownership targets, typically 10-20% at entry, with pro-rata reserves to maintain 7-15% through exit.

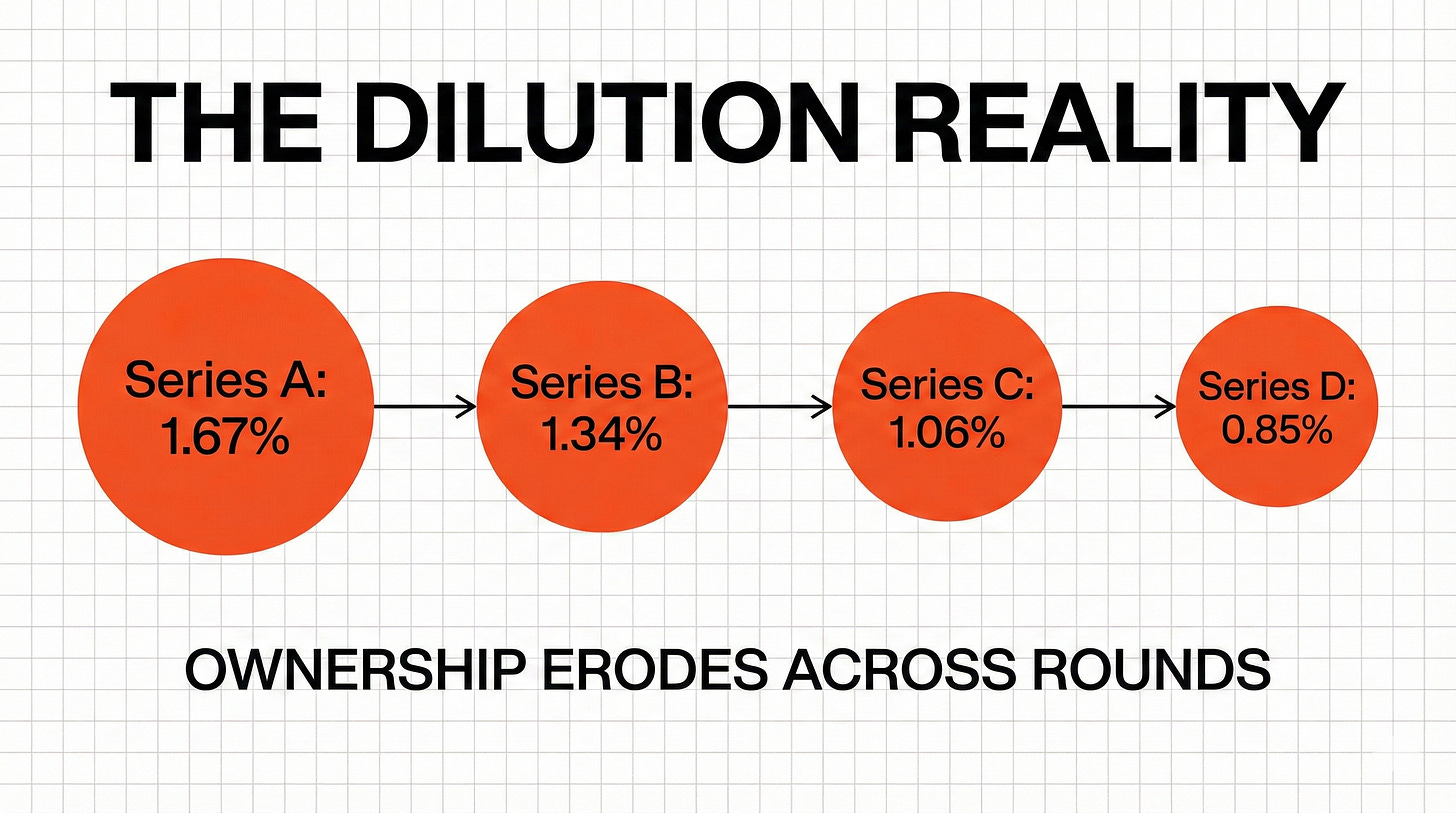

The Dilution Reality Nobody Talks About

But wait, there’s more bad news for small checks.

That 1.67% you sold them? It’s not staying at 1.67%.

Here’s a typical dilution path for a Series A company through exit:

Series A: You sell 20% → Investor owns 1.67% of 100%

Series B: Company raises $15M at $60M pre, sells 20% → Investor now owns 1.67% × 80% = 1.34%

Series C: Company raises $40M at $150M pre, sells 21% → Investor now owns 1.34% × 79% = 1.06%

Series D: Company raises $75M at $300M pre, sells 20% → Investor now owns 1.06% × 80% = 0.85%

Employee option pool refreshes: Another 5% dilution across rounds → Final ownership ≈ 0.75%

So that $250K investment at 1.67% initial ownership? By the time you exit, they’re looking at 0.75% of the outcome.

New exit math:

$200M exit: $1.5M return (6× money, but 2.5% of fund)

$500M exit: $3.75M return (15× money, but 6.3% of fund)

$1B exit: $7.5M return (30× money, but 12.5% of fund)

Even the unicorn scenario is now just a “nice win” rather than a fund-defining moment.

Meanwhile, the investor who put in $2M at 11.8%? After the same dilution:

Final ownership: ≈5.3%

$500M exit: $26.5M (still meaningful)

$1B exit: $53M (still potentially fund-returning)

This is why pro-rata rights and reserve allocation are so critical to VCs. And why they need meaningful initial ownership to make those reserves worthwhile.

The Signal You’re Actually Sending

When you say “only $250K left,” here’s what sharp VCs hear:

Signal 1: You don’t understand venture economics

You think you’re creating urgency. They hear: “This founder is optimizing for getting the round closed vs. building a strategic cap table.”

Signal 2: You’re not thinking about fund dynamics

VCs need to deploy $1-3M per company on average to make their portfolio construction work. A $250K check breaks their model.

Signal 3: This probably won’t be a huge outcome

If you really believed this was going to be a $500M+ company, why would you be optimizing for fitting in extra $250K checks? You’d be reserving allocation for investors who can lead your next round and defend their ownership.

Signal 4: You’re not being selective about your investors

The best founders I know say: “We’re looking for 2-3 lead investors who want to own 10-15% each.” They’re building a board and a long-term partnership. Not filling a bus with tourists.

What the Data Shows About Check Sizes and Success

Let’s look at some actual numbers from successful venture outcomes:

According to PitchBook data on US venture-backed exits over $100M (2015-2023):

Series A investors in successful companies typically:

Invested $3-8M at entry

Owned 12-18% post-money at Series A

Owned 6-12% at exit (post-dilution)

Returned 5-15× their fund from their best investments

Series A investors who invested <$500K:

Made up less than 8% of meaningful returns in $100M+ exits

Were largely angels, scouts, or opportunistic micro-VCs

Rarely participated in follow-on rounds

Had minimal influence on company outcomes

The pattern is clear: meaningful checks correlate with meaningful outcomes. Not because the check size causes success, but because:

Serious ownership demands serious diligence

Large investments justify board seats and strategic support

Pro-rata reserves align investor incentives long-term

Capital concentration signals conviction to other investors

The Fundraising Strategy Shift

Here’s what strong founders do differently:

Instead of: “We have $250K left at $15M”

They say:

“We’re raising $5M at $15M pre. We’re looking for 2-3 institutional lead investors who each want to own 8-12%. If you believe we can build a $500M+ company in this space, we should talk about what meaningful ownership looks like for your fund.”

Instead of: Creating artificial urgency around small allocations

They create:

“We’re being selective about our Series A investors. We want partners who will have enough ownership that this investment matters to them in 5 years, because that’s when their advice and pro-rata capital will matter to us.”

Instead of: Optimizing to squeeze more checks in

They optimize:

“We’re reserving 60% of the round for our lead investors, 25% for strategic angels and advisors who can help with [specific areas], and 15% for high-conviction funds who want to build a relationship for the next round.”

This signals:

Strategic thinking about capital

Understanding of long-term partnership

Confidence in the outcome

Sophistication about venture dynamics

The Counterargument (And Why It’s Wrong)

I can hear the pushback:

“But I’m just trying to maximize the people who can help us. More investors = more network value.”

Let’s test this:

Option A: 20 investors with $250K each ($5M total)

Average ownership: 1.67% → 0.75% at exit

Each investor’s stake at $300M exit: $2.25M

Economic incentive to help you: Marginal

Cap table complexity: High

Board seat dynamics: Messy

Likelihood they defend their pro-rata: Low

Your access to their time: Diluted across 20 companies

Signaling to Series B investors: Scattered, unfocused round

Option B: 3 investors with $1.5M each ($4.5M total) + $500K from angels

Lead ownership: 9.4% each → 4.2% at exit

Each investor’s stake at $300M exit: $12.6M

Economic incentive to help you: High

Cap table complexity: Low

Board seat dynamics: Clean

Likelihood they defend their pro-rata: Very high

Your access to their time: Focused, prioritized

Signaling to Series B investors: Strong conviction from quality firms

The data supports Option B. According to research from Index Ventures analyzing 1,000+ portfolio companies:

Companies with 3-5 Series A investors had 2.3× higher Series B success rates than companies with 10+ investors

Cap table concentration correlated with faster follow-on rounds

Companies with lead investors owning <8% were 3.1× more likely to struggle raising their Series B

When Small Checks Actually Make Sense

Look, I’m not saying small checks are always wrong. There are legitimate scenarios:

1. True strategic angels

$25-50K from an executive who was CMO at a relevant public company and will make 3 customer intros? That’s valuable regardless of ownership.

2. Signal value from brand-name investors

If Sequoia Scout or a16z says “we can’t lead but want to put in $250K,” that’s a signal to other investors. Take it.

3. Filling the last $200-300K of an already-concentrated round

If you’ve got 2-3 leads who own 25% combined and you’re just topping off? Fine.

4. Pre-seed/seed rounds where $250K IS a meaningful check

If you’re raising $1.5M at $6M pre, a $250K check is 14% ownership. That’s different math.

But at Series A and beyond? When you’re raising $5M+? The “$250K left” line is working against you.

The Real Reason VCs Pass on Small Allocations

I asked a partner at a top-tier growth fund why they passed on a company where they could only get $500K in (the company ended up exiting at $800M).

Her answer:

“We knew it would be a good outcome. But at 0.8% ownership, even a $800M exit is only $6.4M to us. That’s 4% of our fund. We’re a four-partner team managing $150M. We can’t afford to spend 15% of our time on something that maxes out at 4% of our returns.

For us to take a board seat and really help, we need to believe it could return 30-50% of the fund. That requires 8-12% ownership. Below that, we’re just tourists.”

This is the core insight: VCs have to allocate their scarcest resource (time) against their portfolio.

A partner at a typical fund has:

8-12 board seats

20-30 total portfolio companies

~2,000 working hours per year

If they’re spending 200 hours per year on your company (board meetings, strategic sessions, recruiting help, customer intros), that’s 10% of their annual capacity.

For that time investment to make sense, you need to be able to contribute 10%+ of their fund’s returns.

Quick math:

Their fund: $60M

Target return: 3× → $180M total

10% of returns: $18M needed from your company

Your exit: $300M

Required ownership: $18M / $300M = 6%

Below that threshold, they’re misallocating their time relative to fund impact.

How to Actually Create Urgency (Without the $250K Line)

If you want to create real urgency in a fundraise, here’s what works:

1. Momentum metrics

“We’re growing 25% MoM. We’ll be 40% bigger when this round closes in 6 weeks.”

2. Competitive dynamics

“We have two term sheets. We’re deciding between them based on strategic fit, not just terms.”

3. Market timing

“Three competitors just raised in the last 90 days. The category is getting validated. We’re the leader now but that window won’t last.”

4. Operational milestones

“We’re expanding to Europe in Q3 regardless of this round. The question is whether we do it with $4M or $7M in the bank.”

5. Insider conviction

“Our existing investors are taking 60% of the round. We’re allocating the remaining 40% to new investors who can help with enterprise sales.”

Notice none of these are about artificial allocation scarcity. They’re about business momentum and strategic opportunities.

BEST FOUNDERS UNDERSTANDS VC

The best founders I know don’t play allocation games. They understand that venture capital is about:

Building ownership positions that matter economically

Partnering with investors who have time and incentive to help

Creating a cap table that signals focus and conviction

Preserving optionality for future rounds

When you say “only $250K left,” you’re optimizing for none of these.

Instead, say this:

“We’re looking for investors who want to own 8-15% and believe this can be a $500M company. If you’re interested in building that kind of position, let’s talk about what real partnership looks like.”

That’s how you create urgency with the right investors.

Because the VCs worth having on your cap table aren’t afraid of missing $250K.

They’re afraid of missing the chance to own 10% of your $1B outcome.

Questions, disagreements, or pushback? Drop them in the comments — I read and respond to everything.

If you’re raising, send your deck to mohidul.alam@antler.co

And before you do, spend 2 minutes with this VC Power Law Simulator to understand how investors actually think about ownership and outcomes:

https://www.mohidulalam.com/tools/power-law-simulator