They Never Raised for a Cup of Coffee, Yet Now They Have Become Private Equity and Credit Fund Managers

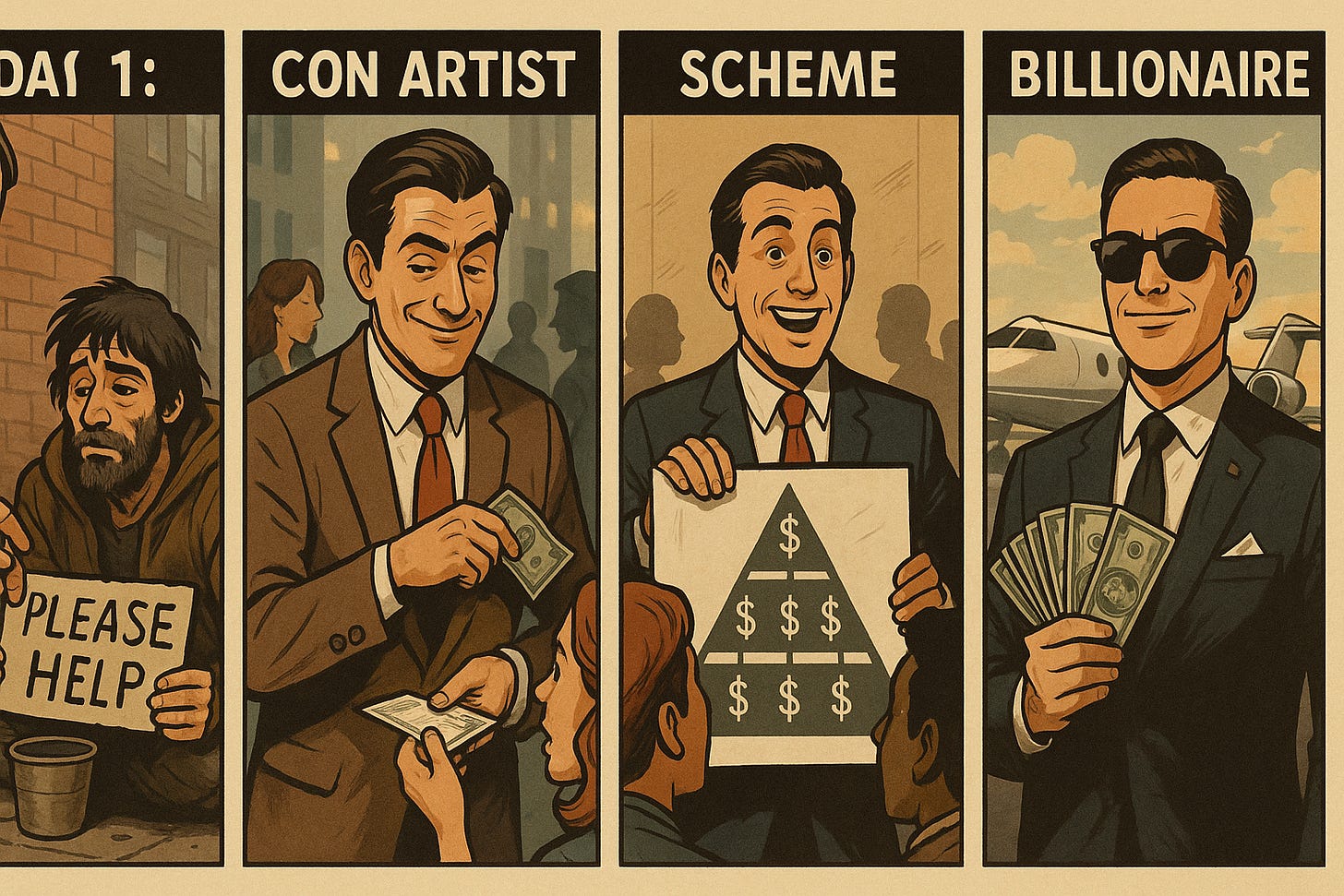

A new wave of self-proclaimed fund managers is selling dreams without a dollar of experience

Over the past year, Bangladesh has witnessed an alarming new trend, a sudden rise of self-proclaimed private equity and lending general partners who have never raised a single dollar from any legitimate limited partner, never built a real company, and never managed a fund. Yet, overnight, they appear on social media as confident hedge fund manager Bill Ackman promising extraordinary returns, numbers so inflated they claim to double the performance of the S&P 500 and even “beat every index fund in human history.” Warren Buffet should take a look here asap to make his “paisa double” quickly.

When you look closer, the reality is far less glamorous. None of these so-called fund managers have formal financial education, any recognized certification, or even the basic understanding of how private equity/credit lending actually works. They are GREAT social media writers; skilled in amusing storytelling!

The playbook they follow is disturbingly similar. It begins with creating a shell company, a name, a logo, a website, nothing more than a digital front. Then they start producing content: posts about “Halal investing,” “Halal capital,” “Islamic finance,” and “financial freedom.” The goal is to build domain authority online, not to build a business. Once their content attracts attention, they shift gears and start talking about investment opportunities.

At first, they pitch equity investments in startups. Their theory is simple but dangerous: “90% of startups fail, so if mine fails, it’s okay, that’s the risk of equity.” It sounds intellectually honest, but it’s a smokescreen. They never disclose their lack of experience, financial controls, or governance structures. Most of these storytelling fail within 3 months cycle. But instead of stopping, they reinvent themselves, this time playing with faith and emotion.

The second act of the scheme is always wrapped in religious sentiment. They start calling it Halal investing. They claim to provide interest-free profit-sharing models, all while promising investors double their money within three years. For millions of small savers across Bangladesh; teachers, shop owners, students, migrant workers, it sounds like a miracle. People who have saved a few lakh taka over years see this as their chance to finally “make it.”

But this is where the manipulation runs deep. Each of these social media fund promoters carefully includes a female co-founder, “board member,” or “advisor” in the team. This isn’t inclusion; it’s marketing. The presence of a woman gives the illusion of legitimacy, balance, and modern professionalism. It disarms skepticism and builds trust. It’s the same emotional tactic that past scams used, a face that looks credible to hide what’s really happening underneath.

We have seen this movie before. First, it was Eval: the e-commerce boom that ended in disaster when millions vanished. Then came the wave of fintech companies making unrealistic promises of “financial inclusion,” which led to widespread losses and shattered confidence. Next came the OTA (Online Travel Agency) implosions like Flight Expert. Each wave starts with hype, fueled by influencers, and ends with mass financial pain.

This new “private equity and lending” wave is just the latest reincarnation of that same formula, a Ponzi-like structure dressed in modern financial language and moral appeal. The difference is that this time, it directly targets trust and faith, making it far more dangerous.

If this continues unchecked, Bangladesh’s entire financial credibility could face another crisis. Micro-lending institutions, which serve millions of low-income people, could collapse under the pressure of eroding trust. Fintech innovators, those genuinely trying to build real impact, will be forced to operate in an environment poisoned by fraud and suspicion.

The government must intervene immediately. Regulatory agencies should begin auditing these self-proclaimed funds, trace their fundraising activity, and publicly disclose who they are and where the money is going. There must be stricter oversight of unlicensed fund-raising activities, and the media must be vigilant in distinguishing between legitimate investment professionals and social media opportunists.

Bangladesh cannot afford another Evaly, another wave of financial chaos, or another generation of savers losing everything to a clever story. What we are seeing is not innovation, it’s imitation of fraud, polished for a digital age.