The Missing Middle of Bangladesh Fintech

The path forward lies in unlocking mid-stage capital and new categories

When I look at startup ecosystems around the world, every country has that one vertical that defines its early story.

Silicon Valley began with semiconductors before it expanded into software.

India’s story was written by IT outsourcing, which created an entire generation of entrepreneurs.

Nigeria had digital banking, which became the wedge that pulled millions into the tech economy.

Bangladesh?

The story begins with fintech. It was always going to be this way. In a country where most people own a phone but don’t have a bank account, money was the obvious starting point. The need was urgent, the opportunity was massive, and fintech became the first real proving ground for venture capital in Dhaka.

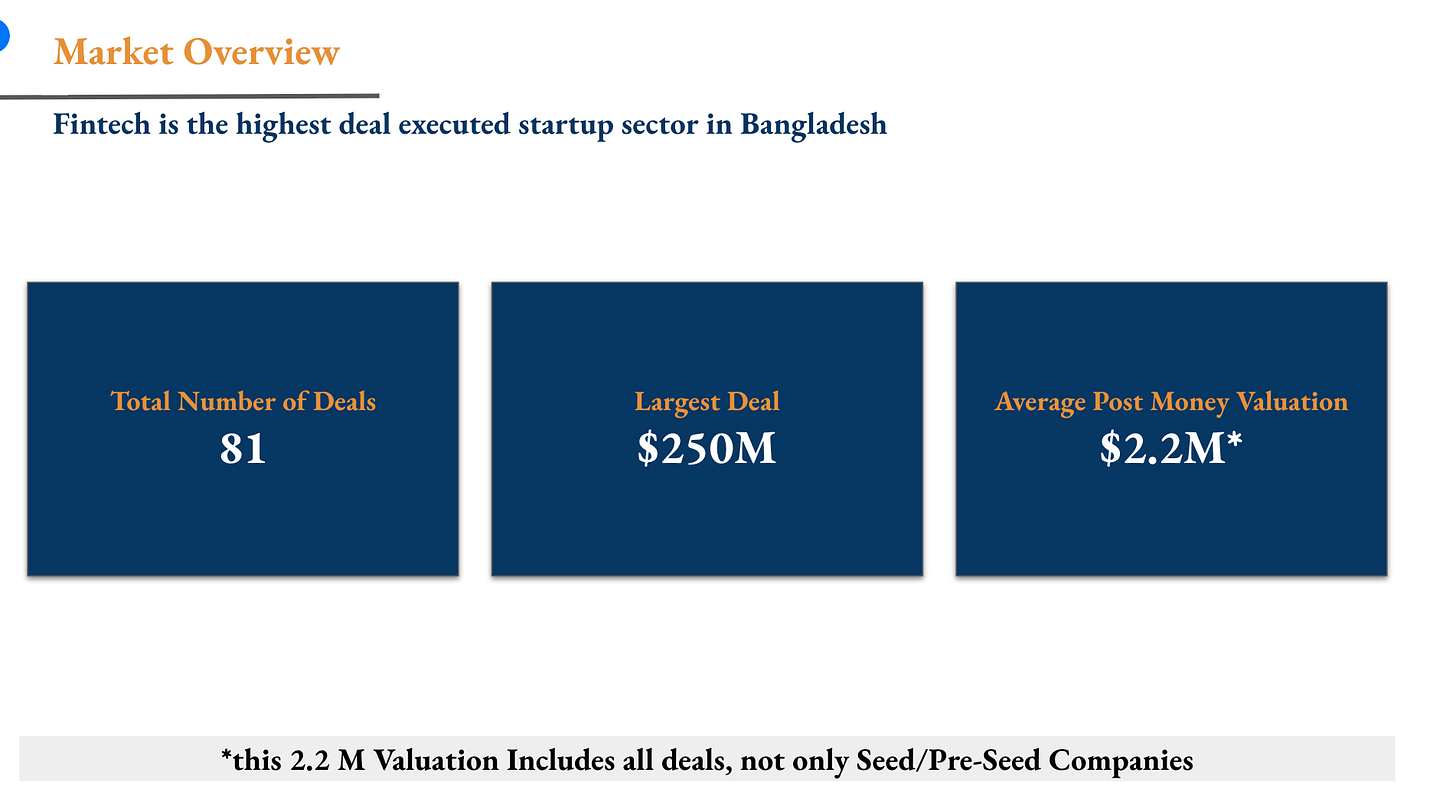

The Big Picture

Fintech is not just one of many verticals in Bangladesh. It is the vertical that carries the ecosystem’s reputation, the one that brought in the largest checks, and the one that gave us our first global headlines.

81 deals in fintech, the most of any sector

$510M raised, over half of all startup capital in Bangladesh

$2.2M average valuation, showing how early we still are

$250M SoftBank into Bkash, the country’s defining deal

Two companies stand out: Bkash and ShopUp. They are the category leaders that showed the world what Bangladeshi fintech could look like at scale. But beneath them, a second wave is starting to form — smaller, less known, but equally important in showing how fintech is diversifying.

Priyoshop – $9M, B2B commerce

SureCash – $7M, payments

Ifarmer– $3M, Agri-fintech

PayWell – $2M, infrastructure

Zatiq – $1.6M, retail fintech

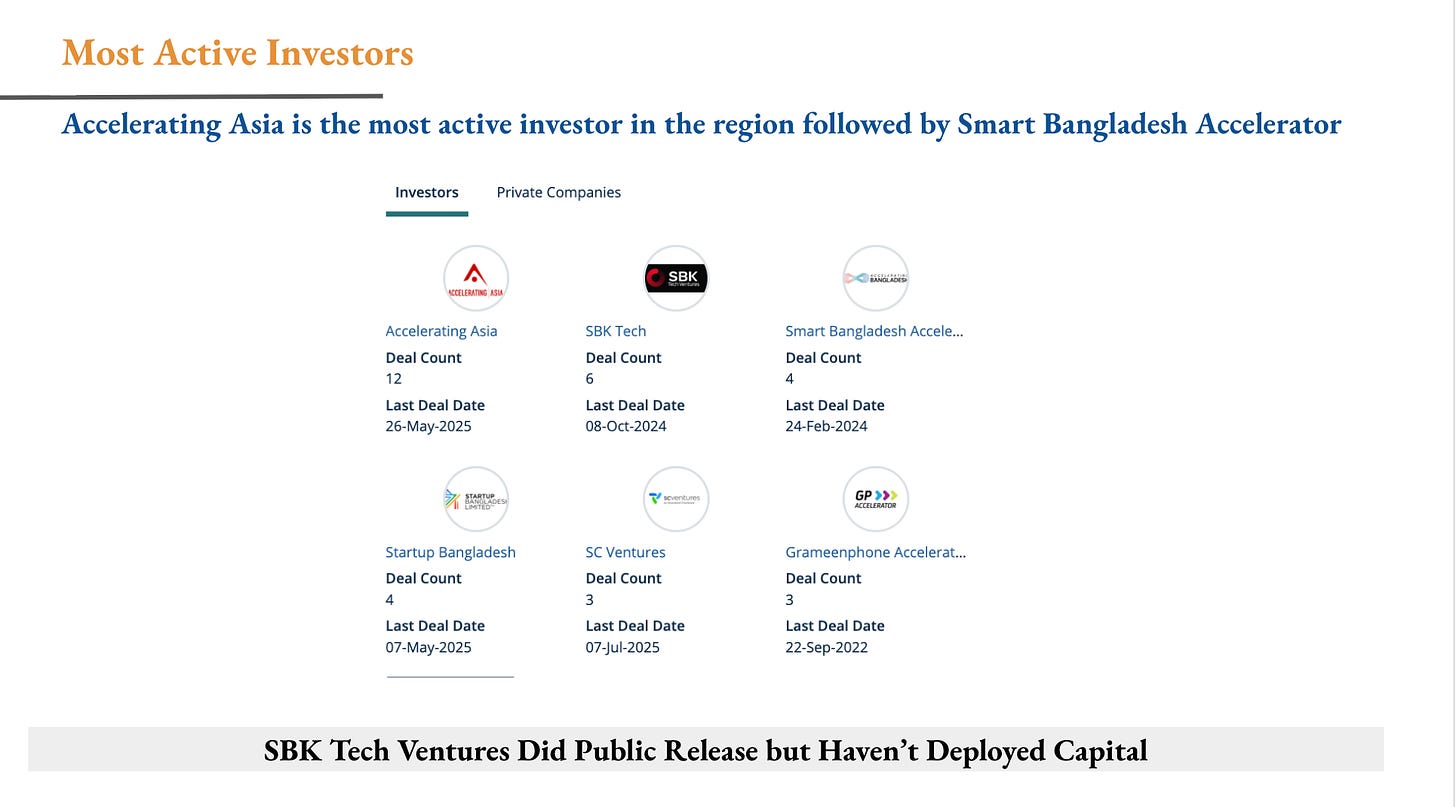

The Shape of Capital

This is where Bangladesh looks different from other markets. In India or Indonesia, venture funds drive the bulk of activity. Here, it has been accelerators doing the heavy lifting. That shapes the way companies grow, the kind of support they get, and the kind of capital they have access to.

Accelerating Asia and Smart Bangladesh Accelerator most active

Four of top five ACTIVE backers are accelerators,

not fundsLocal VCs like

SBK Tech Ventureshas announced deals but founders didn’t have cash in BankSoftBank’s $250M into Bkash is the outlier at the top

The missing middle: no steady $5M–$20M growth checks

For founders, this means either staying small or going global early to raise. For investors, it highlights a structural opportunity.

The Slowdown

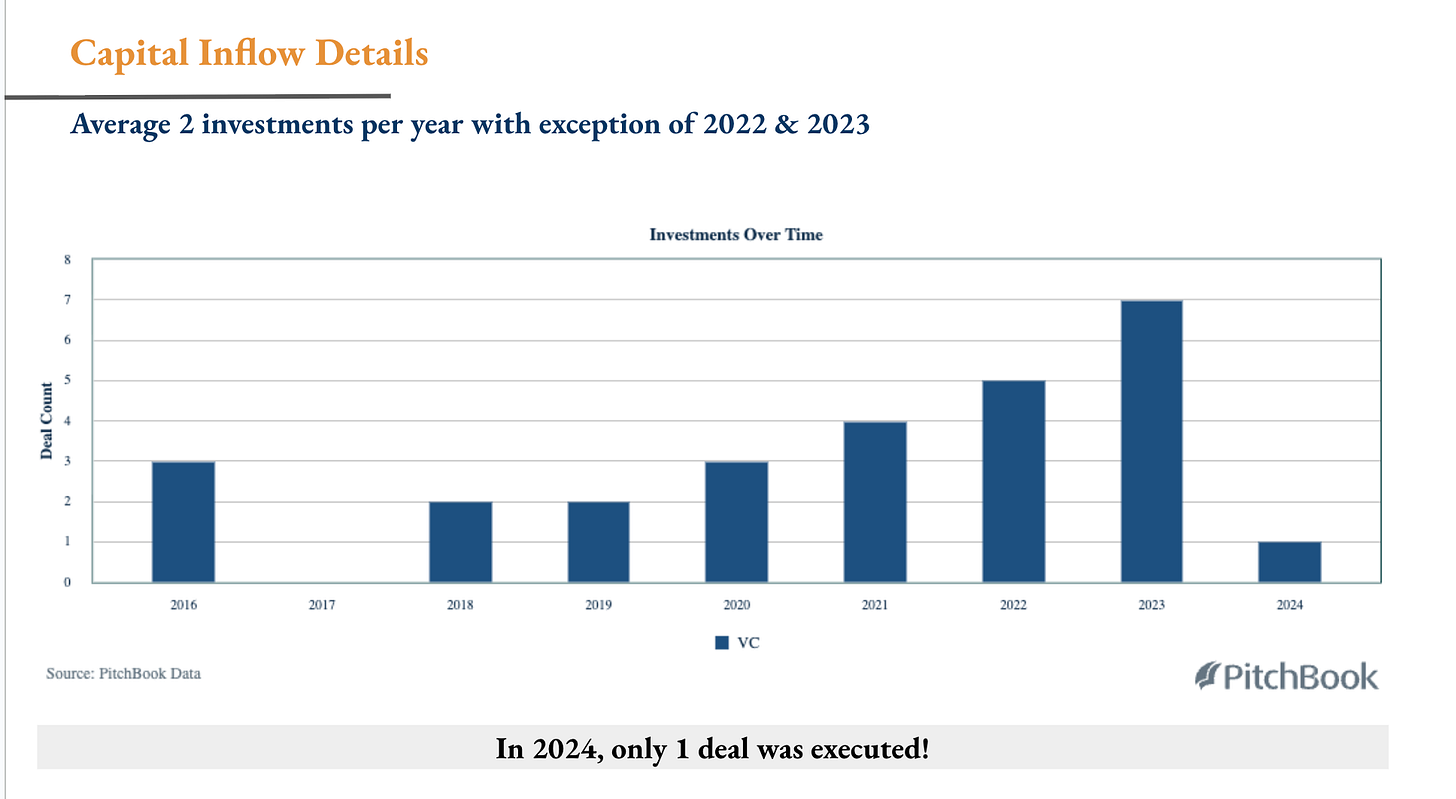

Momentum has slowed. The ecosystem once had steady, if modest, deal flow. But the last year has shown how fragile that pipeline can be.

Average of ~2 deals per year

Only 1 deal in 2024

Concentration in payments and supply chain finance

The slowdown reflects global venture headwinds, but also something more specific: investors want to see new stories, not just repeats of the old ones.

Lessons From SEA

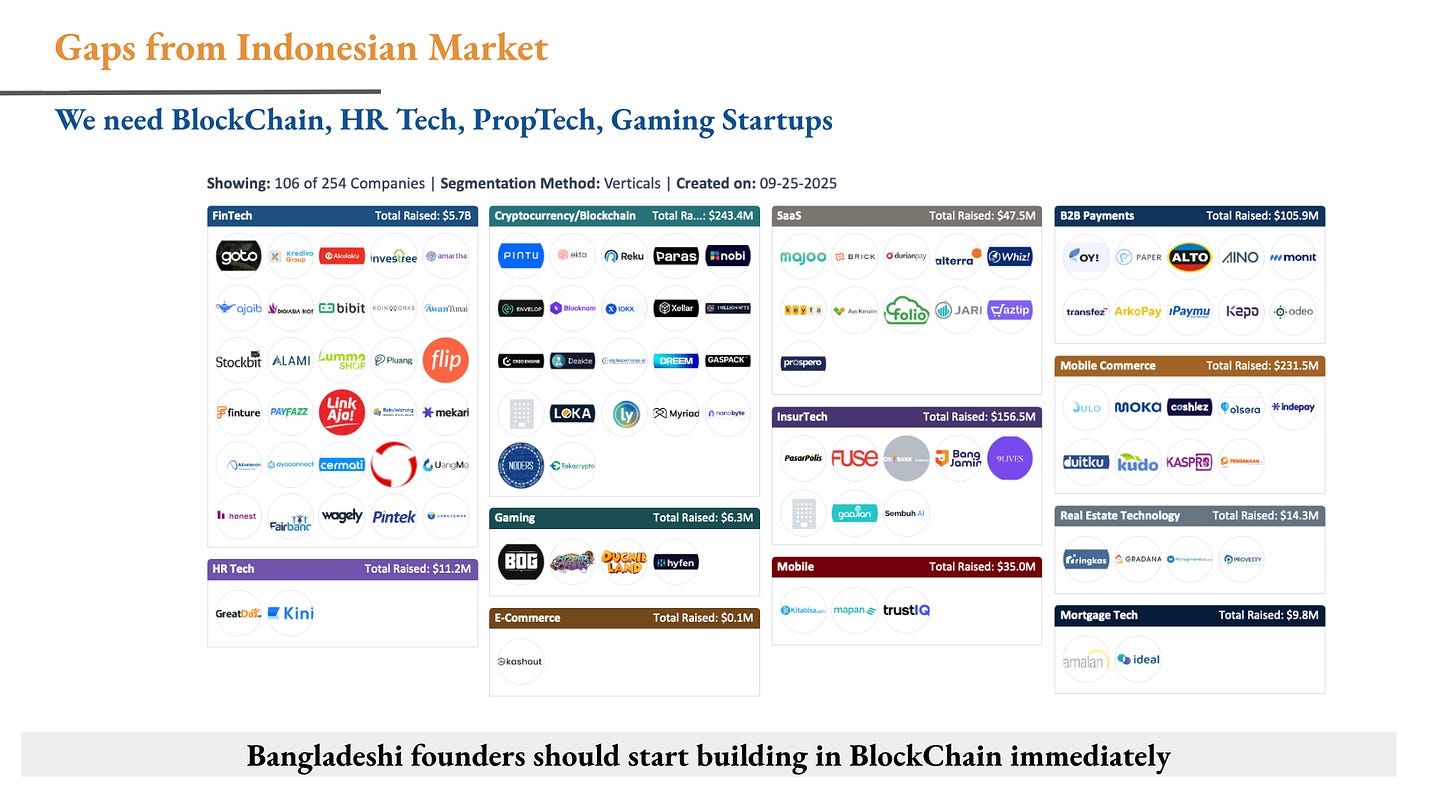

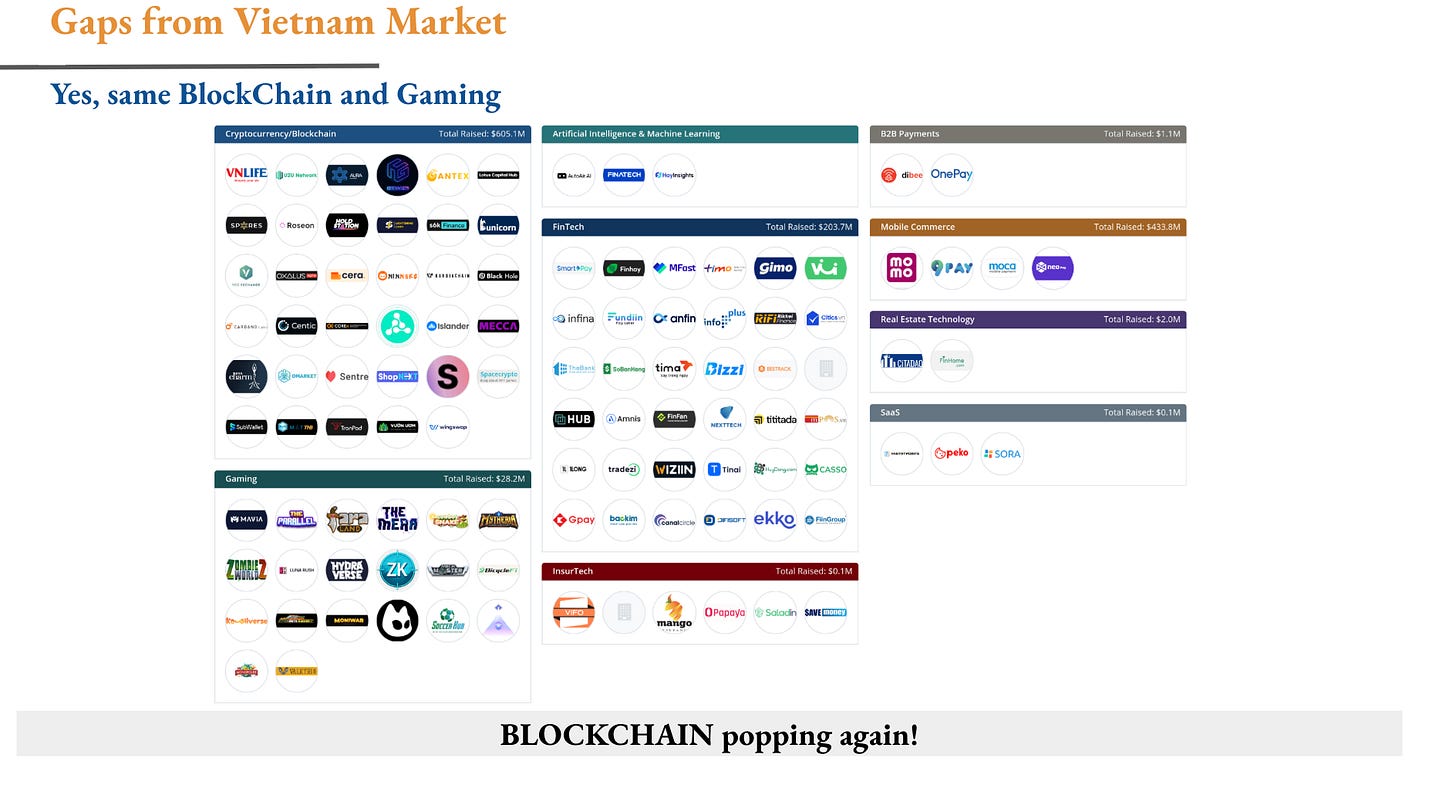

When I look across Southeast Asia, one thing stands out: every market started with payments, but then quickly expanded into new categories. That’s where the real momentum came from. Bangladesh hasn’t made that leap yet.

Indonesia – wallets like GoPay (GoTo) and OVO, but also Xendit in payments infrastructure, and Pinhome in proptech-fintech lending

Philippines – crypto-driven remittances with Coins.ph, mainstream wallets like PayMaya (now Maya Bank), and cross-border platforms targeting the OFW diaspora

Vietnam – gaming-linked finance with Axie Infinity (Sky Mavis), digital banking from Timo and MoMo, and experiments in embedded finance at scale

Bangladesh is still thin in all of these. That is the opportunity.

No blockchain finance yet

No gaming + fintech

No proptech-finance hybrids

No serious HR/payroll fintech

What Comes Next

The next Bangladeshi unicorn will not look like Bkash. It will be something new, built in the gaps we’ve ignored so far. Founders will need to take bigger swings, and investors will need to step into spaces that feel riskier but have already been validated elsewhere.

Founders – use accelerators as launchpads, but build for bigger TAMs (remittances, SME credit, embedded finance)

Investors – step into the missing middle; growth checks are where the upside lies

Ecosystem – push for blockchain, gaming, proptech-finance to leapfrog

Bangladesh already proved fintech works. Now the challenge is to prove it can transform.