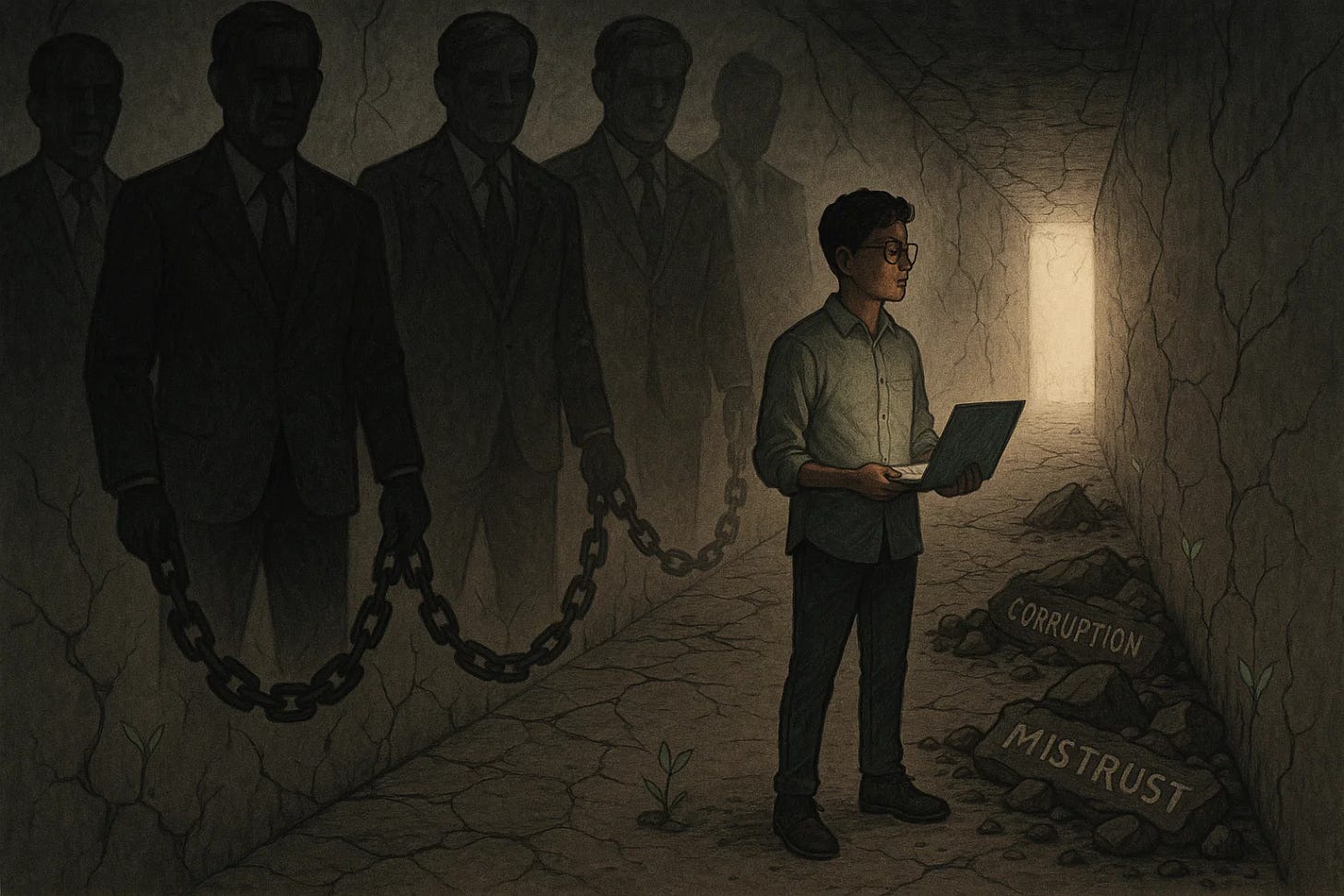

The Cost of Broken Trust: Why Bangladesh’s Startup Future Is at Risk?

Reputation is the most valuable currency in venture capital—and Bangladesh is burning through it fast.

Over the past several years, Bangladesh has shown tremendous promise as an emerging market for technology and venture capital. From Dhaka to Chattogram, a new generation of entrepreneurs and engineers has been building software, platforms, and infrastructure that could one day rival the best in South Asia. Global investors took notice. So did we.

From my base in the United Arab Emirates, I work for a venture capital firm that has already allocated over $25 million into Bangladeshi startups. I remain closely connected to nearly every major fund looking to invest in the region. At one point, Bangladesh appeared poised to produce the next generation of globally backed startups. The talent is here. The ambition is clear. The Gen Z of Bangladesh has the potential to raise from firms like Accel, Sequoia, and Lightspeed.

But something is going wrong.

The perception of the ecosystem is deteriorating rapidly—and it’s not because of external forces. It’s because of repeated actions by a group of local founders who have misused trust, capital, and credibility.

One recent example is the collapse of trust around Flight Expert. Within 10 to 12 hours of that incident becoming public, I witnessed multiple venture funds shift their positions on Bangladesh deals. Positive conversations went cold. Investors are not only walking away from individual companies—they are reconsidering the entire market.

The reputational damage is far-reaching. A quick online search of Bangladesh’s top fintech, e-commerce, or OTA platforms will surface serious allegations and investigations. Several of these companies once carried the national hope for tech innovation. Now they are more commonly associated with fraud, unpaid dues, or mismanagement. One of the most loved banks by retail users has also recently faced questions.

These issues may be isolated in operations,

but they are cumulative in perception.

In venture capital, trust is everything.

And when the world begins to associate your country’s ecosystem with consistent governance failures and ethical concerns, the capital dries up. Even if 99% of founders are ethical, the actions of the remaining 1% can discredit the entire system.

The true victims of this are not the founders who caused the scandals.

The true victims are the Gen Z entrepreneurs who are just starting out.

These are the young builders who could define the next decade of Bangladesh’s growth. They are the ones who now face questions in every investor meeting. They are the ones who are forced to explain away scandals they had no part in. They are the ones whose chances at raising international capital are now lower—simply because of timing.

Rebranding is not reform.

In the wake of each scandal, we often see a wave of rebranding efforts. New WhatsApp groups titled “Rebuilding Bangladesh” or “Bangladesh 2.0” begin circulating. There are social media posts, panel discussions, and community efforts to put forward a new image.

These may be well-intentioned, but they are not enough.

Rebuilding Bangladesh’s startup ecosystem cannot be done through branding alone. It requires serious reform. It requires removing individuals who repeatedly undermine the integrity of the market. It requires active transparency, stronger governance, and real consequences for misrepresentation.

The people who abused this ecosystem cannot be allowed to dominate its narrative. Otherwise, we risk letting one generation of opportunists erase the opportunity of the next.

If we are not careful, the dream of global venture-backed startups from Bangladesh may vanish for years.

This is not only a question of image.

This is a question of economic future.

Startup ecosystems are built on networks of trust and capital. If Bangladesh becomes known more for its frauds than for its founders, we will lose the most promising generation of innovators we have seen.

The Gen Z of Bangladesh deserves a clean slate.

They deserve the chance to build without inheriting the burden of others’ mistakes.

If we fail to protect that, we do not only fail them.

We fail the future of this country’s tech economy.

Now is the time to make difficult choices.

Not symbolic ones.

Not cosmetic ones.

Real change.

Without it, no branding effort will be strong enough to undo the damage that has already been done.