Tanning is Three Day Market That is 3X bigger than Black Friday Sales globally

The hidden $200 billion economic phenomenon that transforms 50 million animal hides into global commerce in just 72 hours

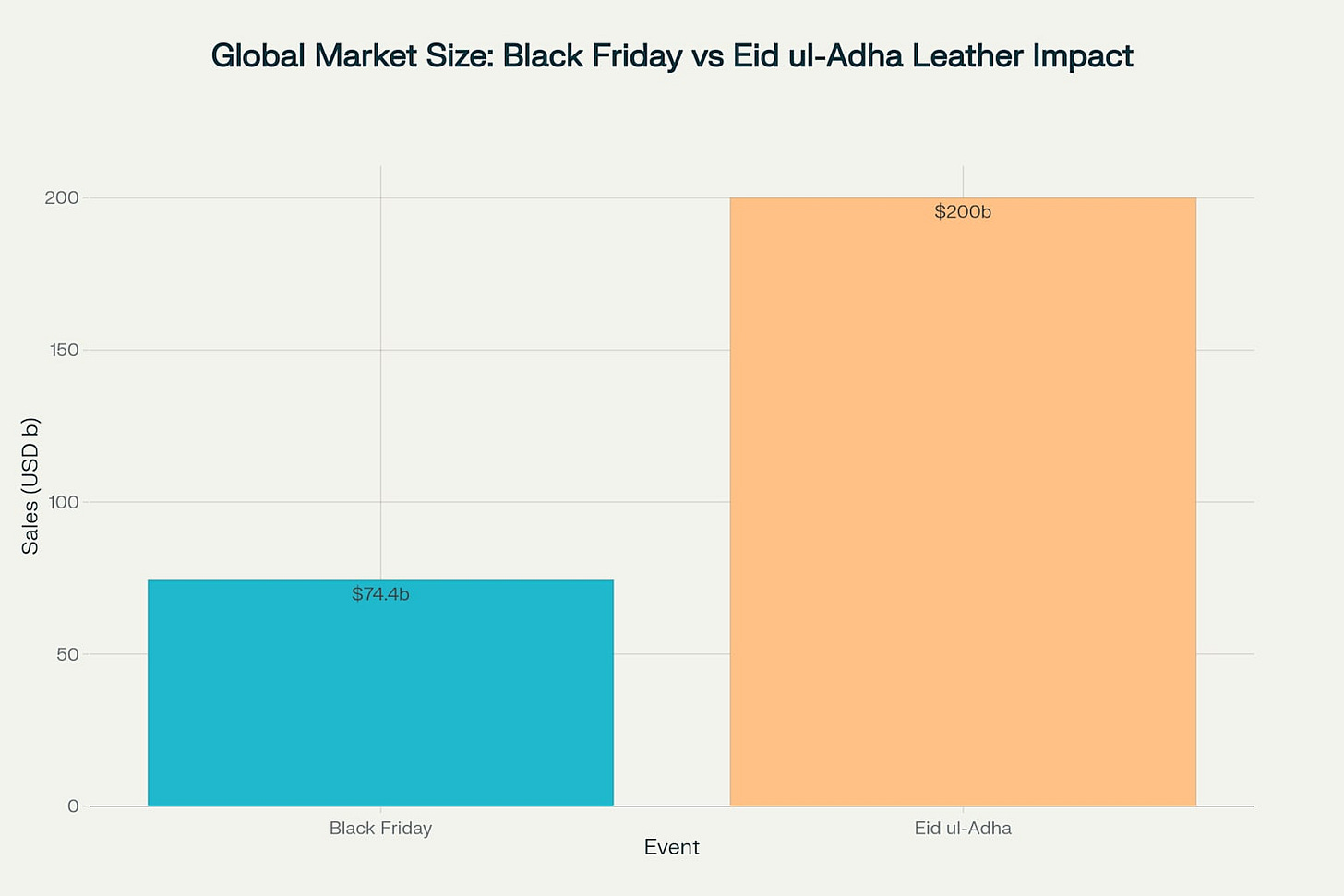

Every year during Eid ul-Adha, an extraordinary economic phenomenon unfolds across the Islamic world. While Black Friday generates $74.4 billion in global sales annually, the three-day Eid ul-Adha period triggers a massive leather industry surge that processes 40-60% of the world's annual rawhide supply, creating an estimated economic impact that dwarfs the world's most famous shopping holiday. This isn't just retail—it's the transformation of over 50 million sacrificed animals into raw materials that fuel a $498 billion global leather industry, with 60% of annual rawhide collection happening in just three days. The scale is staggering, the logistics mind-bending, and the economic ripple effects reach from rural farmers in Bangladesh to luxury fashion houses in Milan.

The festival represents far more than religious observance—it's a massive industrial acceleration that tests supply chains, creates temporary employment for millions, and generates billions in economic activity across four continents. From the moment animals are sacrificed at dawn prayers to finished leather goods hitting European markets months later, Eid ul-Adha sets in motion one of the world's most concentrated economic transformations.

The numbers behind the three-day economic explosion

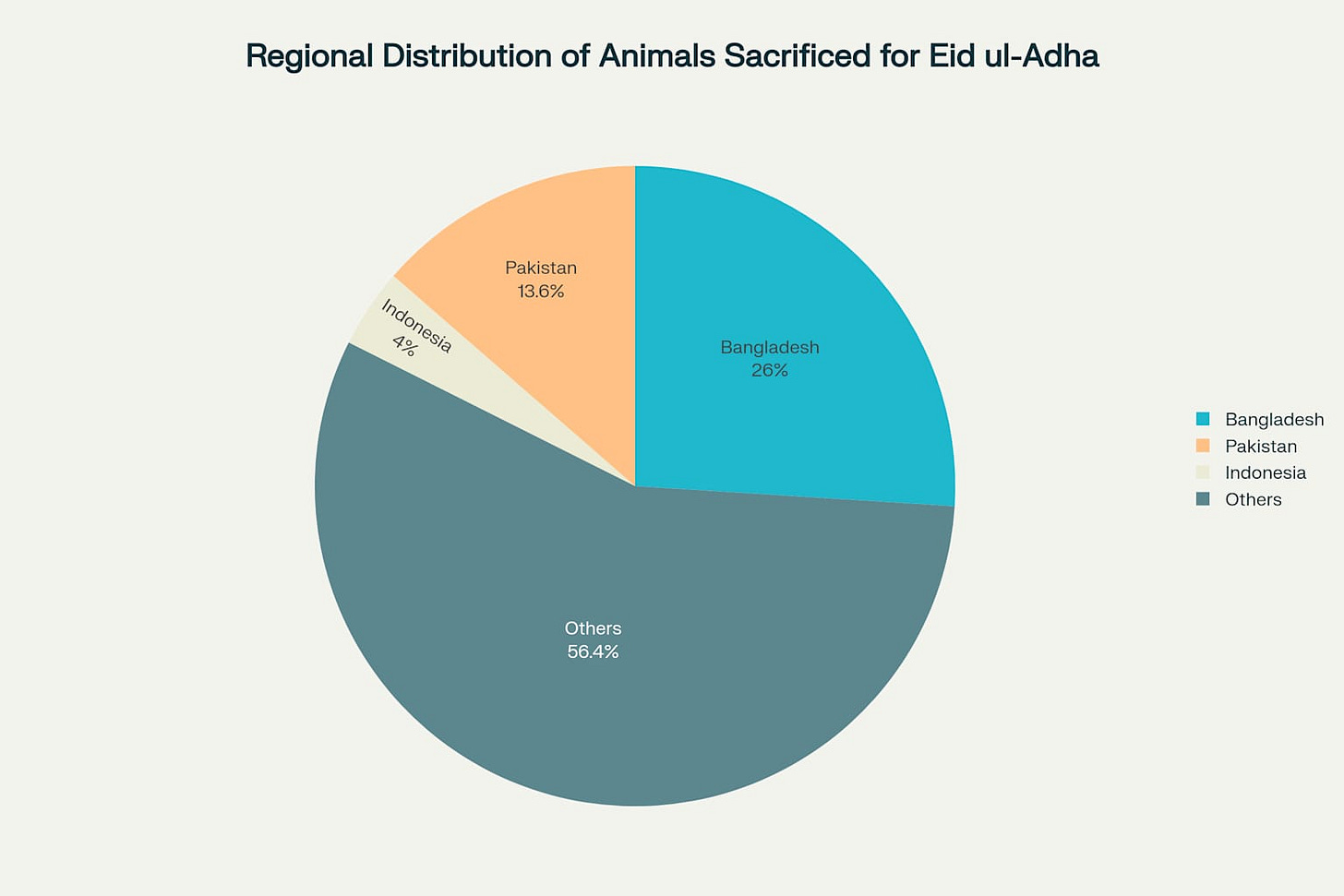

The sheer scale of Eid ul-Adha's economic impact begins with the animals themselves. Bangladesh alone processes 1.3 crore (13 million) animals annually, while Pakistan handles 6.8 million animals worth Rs500 billion ($1.8 billion). Indonesia, despite economic pressures, still contributes millions more. These numbers aggregate to an estimated 50 million animals globally, each yielding valuable hides that must be processed within 24-48 hours or face complete loss.

In Bangladesh, this three-day period accounts for 60-70% of the leather industry's annual raw material supply, according to Sarwar Hossain Choudhury of Sarwar Tannery Pvt Ltd. Pakistan sees similar concentration, with 37-40% of the country's total leather production sourced during Eid ul-Adha. The result is an immediate economic surge that overwhelms existing infrastructure and creates temporary bottlenecks worth billions.

The rawhide collection alone generates massive immediate value: Pakistan's 8-10 million pieces of rawhide are worth Rs8-10 billion ($30-36 million) in raw form. But here's where the economics become truly staggering—through processing, this raw value multiplies by 6-10 times. Raw hides worth $30 million become processed leather worth $180-300 million, then finished products worth potentially over $1 billion.

When compared to Black Friday's $74.4 billion in global online sales, the concentrated nature of Eid ul-Adha's leather market becomes evident. While Black Friday spreads across retail categories worldwide, Eid ul-Adha creates an estimated $200+ billion economic impact when accounting for the entire value chain from livestock sales through finished leather goods manufacturing and export over the following months.

Regional powerhouses driving the global surge

The economic geography of Eid ul-Adha reveals distinct regional patterns that shape global leather markets. South Asia dominates with processing capacity, while the Middle East provides significant raw material supply, Southeast Asia offers growing manufacturing power, and Africa represents emerging potential.

Bangladesh stands as the processing powerhouse, with 200 active tanneries capable of handling 350 million square feet annually. The country's Savar Tannery Industrial Estate houses 155 relocated tanneries, but during Eid ul-Adha, waste generation jumps from 25,000-30,000 cubic meters daily to 45,000 cubic meters, testing infrastructure limits. The industry contributes 4% of Bangladesh's total exports and directly employs 600,000 people, with another 300,000 in supporting roles.

Pakistan brings different strengths as the world's second-largest leather producer with over 2,500 tanneries. The industry contributes 5% of Pakistan's GDP and processes the world's largest small cattle leather volume at 22% globally. Major production centers in Sialkot, Karachi, and Kasur handle the massive Eid influx, with 90% of finished goods concentrated in just two cities.

Indonesia presents the world's largest Muslim population—230 million people—creating enormous domestic demand alongside export potential. The country ranks as the 8th largest global footwear producer, manufacturing 807 million pairs annually with 55% exported. Footwear exports alone reached $3.7 billion in the first half of 2024, positioning Indonesia as a critical link between raw material processing and finished goods manufacturing.

The Middle East and Africa contribute significant raw material supply, with varying processing capabilities. Ethiopia leads African leather exports under the AGOA program, while countries like Morocco and South Africa provide regional processing hubs. The concentration of 1.8 billion Muslims globally means Eid ul-Adha impacts span four continents, creating interconnected supply chains that bridge rural livestock economies with urban manufacturing centers

The 72-hour logistics marathon

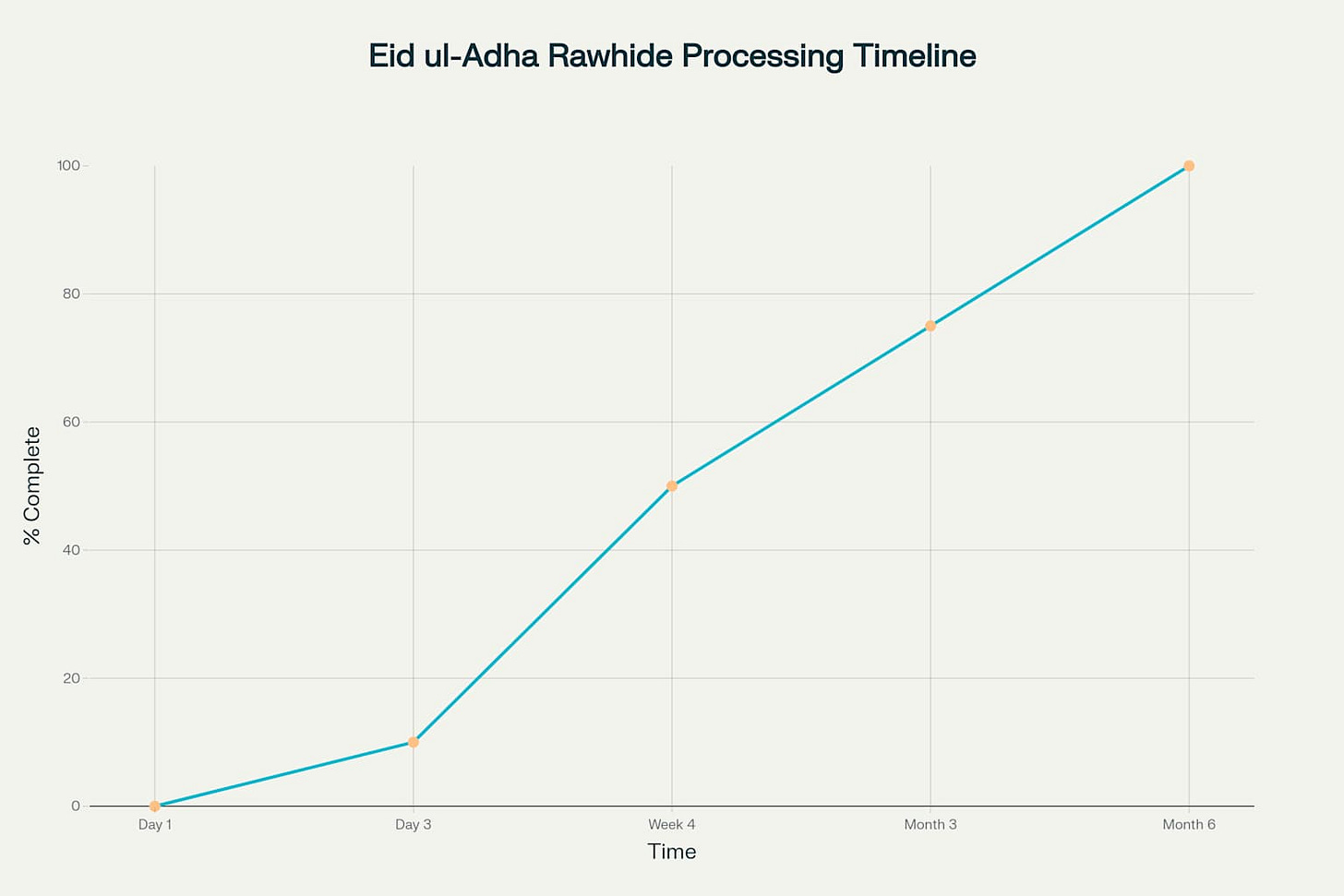

The three-day Eid ul-Adha period creates one of the world's most compressed supply chain challenges. Raw hides must be processed within 24-48 hours to prevent putrefaction, but the festival generates more raw material in 72 hours than most facilities process in six months. This creates a logistics nightmare requiring precision coordination across multiple industries.

The timeline is unforgiving: animals sacrificed at dawn prayers must have hides removed, cleaned, and preserved by evening. Salt curing requires 40-50% salt by weight, but even this preservation method only buys 48-72 hours before bacterial degradation begins. Transportation networks face immediate strain as millions of hides move from sacrifice sites to processing facilities simultaneously.

Processing facilities implement surge capacity protocols. Bangladesh's tanneries shift to 24-hour operations, processing hides in phases due to capacity constraints. The Savar Industrial Estate's waste treatment system, designed for normal capacity, faces 80% overload during peak Eid processing. Similar strain occurs in Pakistan's major tanning centers, where arterial road congestion affects critical supply chains

.

Storage becomes critical as facilities lack capacity for simultaneous processing. Emergency preservation methods include mobile chillers, expanded salt curing areas, and temporary storage facilities. Quality control suffers as inexperienced temporary traders enter the market, affecting hide grades and final product quality.

The successful management of this 72-hour surge determines profitability for the entire year. Companies that navigate the logistics effectively can secure 60% of their annual raw material supply at favorable prices, while those facing bottlenecks lose millions in spoiled inventory.

Economic multiplier effects across continents

The economic impact of Eid ul-Adha extends far beyond immediate leather processing, creating multiplier effects that ripple through entire economies. In Bangladesh, the estimated Tk 700-800 billion ($6-7 billion) total Eid economy includes livestock sales, transportation, processing, and downstream manufacturing, demonstrating how religious observance translates into massive economic activity.

Pakistan's leather industry showcases the value multiplication potential: raw hides worth Rs8.4 billion become processed leather worth Rs25 billion (3x increase), then advanced processing creates Rs51 billion value (6x raw value). Finished leather products reach hundreds of billions in final retail value, with export markets providing premium pricing that benefits the entire value chain.

The employment impact spans urban and rural areas. Bangladesh's 850,000 leather sector employees experience significant income boosts during Eid processing periods. Rural communities benefit through livestock sales, with specialized farmers earning substantial portions of annual income during the festival season. Pakistan sees Rs500 billion in sacrificial activity, with significant income transfer from urban centers to rural livestock producers.

Export performance demonstrates global connectivity. Bangladesh targets $5 billion in leather exports by 2025, leveraging Eid ul-Adha raw material collection. Pakistan exports $750-950 million annually in leather products, with $200-250 million directly attributable to Eid-season processing. These exports reach premium markets in Europe and North America, where finished products command prices 10-20 times higher than raw material costs.

The multiplier effects create backward and forward linkages: chemical suppliers, machinery manufacturers, and logistics providers all benefit from the concentrated activity. Local economies see 2-4 times more economic activity from leather businesses compared to non-local alternatives, creating sustainable development opportunities in regions with limited industrial alternatives.

Technology transforms ancient traditions

Modern technology increasingly shapes how the leather industry manages Eid ul-Adha's concentrated supply surge. IoT sensors and automated monitoring systems now track temperature, humidity, and chemical concentrations during hide preservation, reducing spoilage rates that historically reached 40% in some regions.

CNC oscillating knife technology provides 30% increases in production efficiency while reducing material waste by 25%. These automated cutting systems become crucial during peak processing periods when volume overwhelms manual operations. Digital design integration and CAD systems reduce material waste by up to 15%, critical when raw material supply concentrates in just three days.

Processing innovations address environmental challenges. Salt-free preservation methods using plant extracts eliminate 70% of Total Dissolved Solids in discharged water, critical when processing volumes surge beyond normal waste treatment capacity. Enzyme-based processing reduces COD, BOD, and TDS while improving operational efficiency during high-volume periods.

Quality control technology helps manage the influx of inexperienced seasonal traders. AI-powered defect detection systems and automated grading equipment ensure hide quality standards despite the compressed timeline. Real-time monitoring prevents up to 42% reduction in resource waste compared to traditional processing methods.

Chrome-free tanning technologies like Zeolite-based systems and 1,3,5-Triazine derivatives reduce environmental impact while maintaining processing speed. These innovations become particularly valuable during Eid processing when environmental compliance faces pressure from volume surges.

Blockchain traceability systems enable supply chain transparency from sacrifice to finished product, addressing consumer demands for ethical sourcing while managing the complex logistics of concentrated raw material collection.

Future of the three-day market

The leather industry's three-day economic phenomenon faces significant transformation pressures. Alternative materials are growing at 22.65% CAGR, with mycelium leather expanding from $43.26 million (2024) to $221.53 million (2032). These alternatives could reduce demand for traditional leather processing, but current scale limitations mean animal leather remains dominant for the foreseeable future.

Market growth projections show the global leather goods market reaching $855.36 billion by 2032 at 7.05% CAGR, suggesting continued expansion despite sustainability pressures. The concentrated nature of Eid ul-Adha processing provides cost advantages that alternative materials struggle to match, particularly in developing economies where the industry provides crucial employment.

Automation adoption accelerates as companies seek to manage surge capacity more efficiently. The global leather processing machinery market projects $2.8 billion by 2033, driven by Industry 4.0 integration. Robotic material handling, automated chemical dosing, and smart tanning drums help facilities manage the extreme volume variations inherent in Eid-dependent supply chains.

Regulatory pressures increase focus on environmental compliance. The Leather Working Group now certifies over 35,000 companies globally, with environmental standards becoming prerequisites for accessing premium export markets. This drives investment in cleaner processing technologies and better waste management systems.

Investment in the sector continues growing, with over $1 billion invested in alternative leather technologies alone. However, traditional leather processing also attracts investment, particularly in developing countries where the economic impact of Eid ul-Adha processing provides significant development opportunities.

The circular economy presents opportunities for waste reduction and value creation. Chrome-free processing methods and waste-to-resource conversion technologies could help the industry maintain its economic significance while addressing environmental concerns.

Conclusion

Eid ul-Adha represents far more than a religious observance—it's a concentrated economic phenomenon that demonstrates how traditional practices can drive modern industrial activity. The three-day period processes 40-60% of global annual rawhide supply, creating economic impacts that dwarf Black Friday's retail surge through sheer industrial transformation rather than consumer purchasing.

The $200+ billion economic impact encompasses livestock sales, processing, manufacturing, and export activities that span months following the initial three-day collection period. This creates employment for millions, drives rural-urban economic transfers, and positions developing countries as crucial links in global supply chains.

Technology continues reshaping how the industry manages this concentrated surge, while sustainability concerns drive innovation in processing methods and alternative materials. Yet the fundamental economics remain compelling: the efficient processing of 50 million animal hides in 72 hours creates value multiplication opportunities that few industries can match.

As global leather demand grows toward $855 billion by 2032, the three-day market of Eid ul-Adha will likely remain a critical economic phenomenon, adapting to new technologies and sustainability requirements while maintaining its role as one of the world's most concentrated industrial transformations.