Legal Tech in GCC: Complete Guide to AI Revolution Transforming Middle East Law Firms in 2024

Something big is happening in the legal industry across the Gulf region, and most people haven’t noticed yet.

The GCC (Gulf Cooperation Council) is experiencing a legal technology revolution that could change everything about how law firms operate in the Middle East. From Dubai to Riyadh, from Abu Dhabi to Doha, artificial intelligence and automation are finally reaching one of the most traditional industries in the region.

If you’re a lawyer, a startup founder, an investor, or just someone curious about how technology is reshaping business in the Gulf, this guide will break down everything you need to know about legal tech in the GCC

Let’s dive in.

What is Legal Tech? A Simple Explanation

Before we talk about the GCC specifically, let’s make sure we’re all on the same page.

Legal tech (or legal technology) refers to software and AI tools that help lawyers and law firms work faster, smarter, and more efficiently.

Think about it this way: lawyers traditionally spend hours reading through hundreds of pages of contracts, researching past cases, and drafting legal documents by hand. Legal tech uses artificial intelligence to do these tasks in minutes instead of hours.

Some examples of what legal tech can do:

Review a 100-page contract and highlight potential problems in 30 seconds

Search through thousands of legal cases to find relevant precedents instantly

Automatically generate standard legal documents like NDAs or employment contracts

Predict the likely outcome of a case based on historical data

Manage deadlines, documents, and client communications in one place

It’s like having a super-smart assistant that never sleeps, never makes mistakes, and processes information at computer speed.

The Global Legal Tech Boom: Understanding the Big Picture

To understand what’s happening in the GCC, we need to zoom out and look at the global picture first.

The legal tech industry is absolutely exploding worldwide.

Here are the numbers that tell the story:

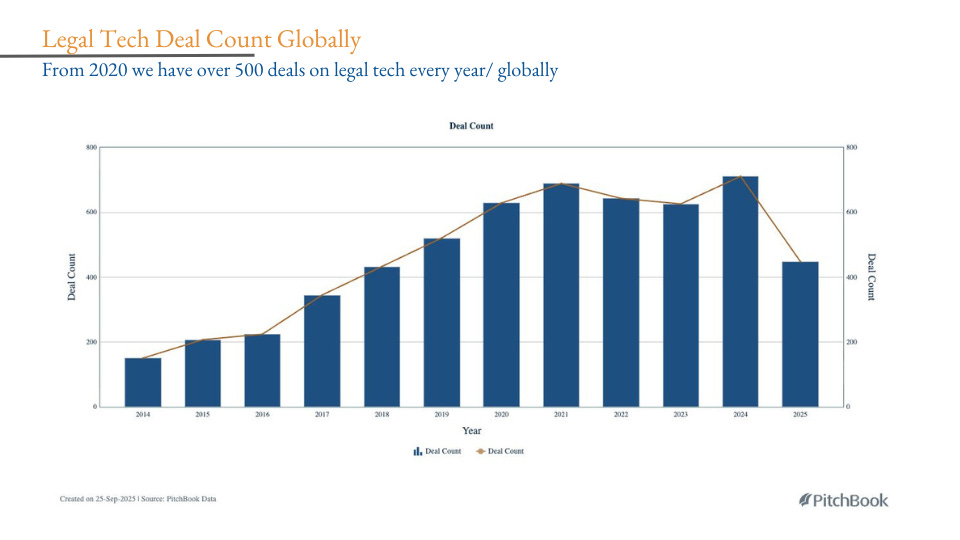

Over 500 Legal Tech Deals Every Year Since 2020

That’s right. Every single year since 2020, venture capital investors have been completing more than 500 deals in the legal tech space globally. That’s more than one deal every single day.

This isn’t a trend or a fad. This is a fundamental shift in how the legal industry operates.

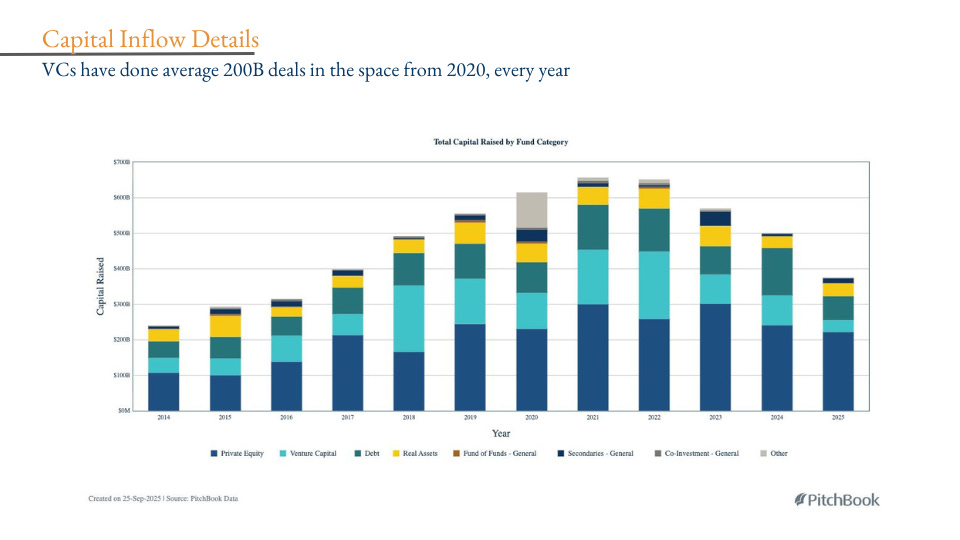

$200 Billion in Annual Investment

Since 2020, venture capitalists have been pouring an average of $200 billion into legal tech deals every year.

To put that in perspective, that’s more money than the entire GDP of many countries. That’s more than the market cap of companies like Netflix or Adobe.

When this much capital flows into a sector, it means smart money has identified a massive opportunity.

Why Are Investors So Excited About Legal Tech?

The answer is simple: the legal industry is one of the last major sectors that hasn’t been transformed by technology.

Banking got fintech. Transportation got Uber. Retail got e-commerce. Healthcare got telemedicine.

But law firms? Most of them still operate like it’s 1995. Paper files. Billable hours. Manual research. Endless email chains.

That’s a massive problem waiting for a solution. And when you have a huge, profitable industry that’s ripe for disruption, investors pay attention.

Legal Tech in the GCC: The Current State of Play

Now let’s bring this home to the Gulf region.

The GCC legal tech market is in its early stages, but things are moving fast. Here’s what the landscape looks like right now.

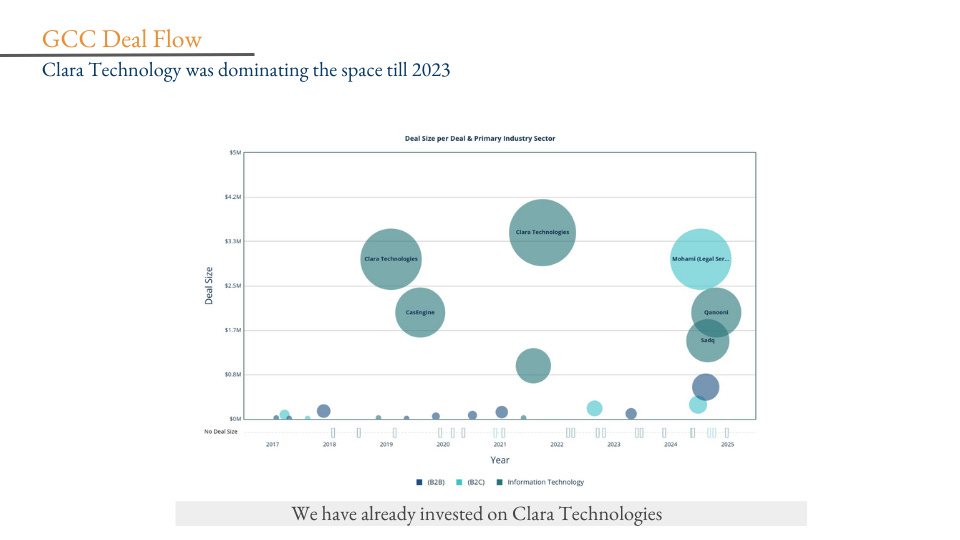

Clara Technology: The Early Dominator

Until 2023, one company essentially owned the GCC legal tech space: Clara Technology.

Clara had the market largely to themselves. They built solid products, gained traction with law firms, and attracted investment. Some forward-thinking investors saw the opportunity early and backed Clara when few others were paying attention.

If you invested in Clara early, you made a smart move. They proved that legal tech could work in the GCC market.

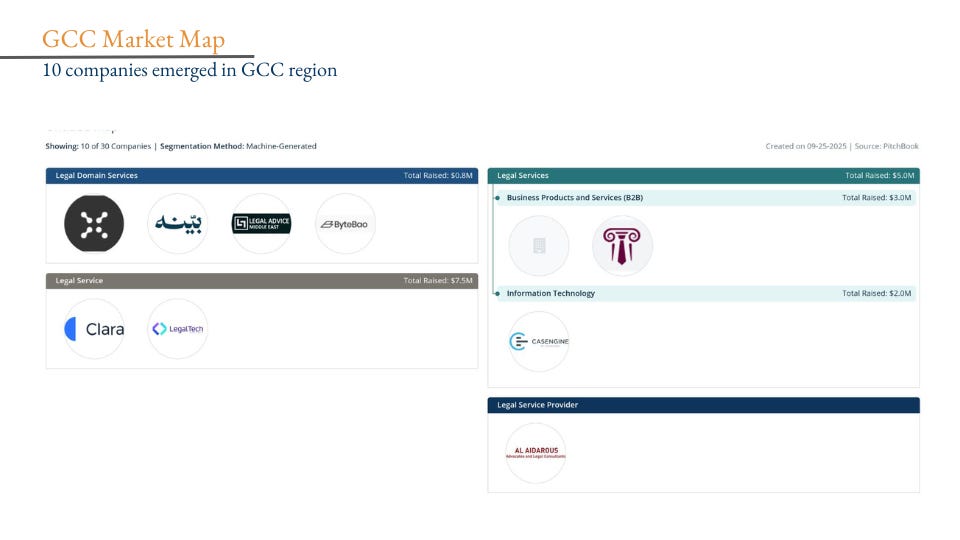

The New Wave: 10 Emerging Startups

But here’s where things get really interesting.

Ten new legal tech companies have now emerged in the GCC region.

This is huge. Competition breeds innovation. When you have multiple companies fighting for the same market, everyone improves their product, drops their prices, and serves customers better.

For law firms in the region, this is fantastic news. You now have options. You can compare features, negotiate better deals, and find the solution that fits your specific needs.

For the ecosystem, this signals that legal tech in the GCC has reached a tipping point. When one company succeeds, it validates the market and attracts more entrepreneurs and more capital.

The GCC Legal Tech Market Size: Small but Global

Let’s talk about market size, because this is where things get counterintuitive.

The GCC legal tech market is extremely small by global standards.

Here are the actual numbers:

There Are 900 Law Firms in the GCC

This includes firms across all six GCC countries: Saudi Arabia, UAE, Kuwait, Qatar, Bahrain, and Oman.

900 firms might sound like a lot, but compared to thousands of law firms in the United States or Europe, it’s tiny.

Maximum Market Size: $3.8 Million Per Year

If 100% of GCC law firms adopted legal tech at an average price of $350 per month, the total annual market would be just $3.8 million.

Here’s the math: 900 law firms × $350 per month × 12 months = $3,780,000 per year.

That’s... not a lot. Tech companies in Silicon Valley raise more than that in seed funding.

Realistic Market Size: $1.1 Million Per Year

But let’s be realistic. Not every law firm will adopt legal tech immediately. Technology adoption in professional services is slow.

If we assume 30% adoption (which would actually be pretty good), the market shrinks to about $1.1 million per year.

So, Why Should Anyone Care About a Million Dollar Market?

Great question. And here’s the answer that changes everything:

These aren’t local products serving only the GCC market.

The smartest legal tech companies in the GCC are building global products. They’re using the Gulf region as a launch pad, not as their final destination.

Think about Harvey AI, one of the most successful legal tech companies in the world. They didn’t limit themselves to one geography. They built a product that works for law firms everywhere.

The same strategy applies here. Companies like Nova Doc and Qanooni aren’t thinking “let’s capture 1% of a $1 million market.” They’re thinking, “let’s use the GCC to build, test, and refine our product, then take it global.”

This is the same playbook that worked for:

Careem (started in the GCC, expanded globally, sold to Uber for $3.1 billion)

Noon (built for the Middle East, now competing with Amazon globally)

Tabby (launched in the GCC, now the region’s most valuable fintech)

Small local markets have produced billion-dollar global companies before. It can happen again.

The Companies to Watch: Who’s Building the Future of GCC Legal Tech

Let’s get specific about who’s actually building in this space. Two companies stand out based on their founding teams and track records.

Nova Doc: The Serial Entrepreneur Advantage

Nova Doc has something that most startups don’t: founders who’ve already won before.

Tariq Sheikh, Co-founder and CEO

Tariq is a second-time founder, which immediately puts him in a special category. Why? Because second-time founders have a much higher success rate than first-timers.

He previously founded Post Pay, a buy-now-pay-later platform that raised $65 million in capital. That’s not luck. That’s someone who knows how to:

Build products people want

Attract top talent

Raise capital from sophisticated investors

Scale operations across multiple markets

When you’ve already raised $65 million once, investors take your next company seriously from day one.

Matej Šircelj, Co-founder and CTO

Matej brings 15+ years of engineering experience to Nova Doc. He’s also a second-time founder with deep expertise in artificial intelligence.

This matters enormously. Legal tech isn’t just about building software. It’s about building AI that can understand legal language, identify relevant information, and make accurate predictions. That requires serious technical chops.

Having a CTO who’s built AI systems before and has already gone through the founder journey once gives Nova Doc a significant technical advantage.

What This Team Means for Nova Doc

Second-time founders have seen the movie before. They know what works and what doesn’t. They’ve made mistakes and learned from them. They have networks of investors, employees, and partners they can activate immediately.

This is why venture capitalists love backing second-time founders. The data shows they’re simply more likely to succeed.

Qanooni: The Perfect Founding Team Combination

If you were designing the perfect founding team for a legal tech company from scratch, it would probably look a lot like Qanooni’s team.

Karim Shiyab: The Legal Expert

Karim brings extensive legal expertise from the frontlines. He founded Legalintro and served as a senior legal advisor at Al Tamimi & Company, one of the largest and most prestigious law firms in the Middle East.

This is crucial. Too many tech companies are built by people who don’t actually understand the industry they’re trying to disrupt. They build features that sound cool but don’t solve real problems.

Karim has lived through the pain points. He knows exactly what frustrates lawyers daily. He understands the workflows, the regulations, the client expectations, and the economics of running a law firm.

Anuscha Iqbal: The Business Builder

Anuscha comes from investment banking and private equity, bringing crucial business and financial expertise.

But here’s what really stands out: she’s already had two successful exits.

She co-founded Spotii, a buy-now-pay-later platform that was acquired by Zip Co (an Australian fintech giant). Then she co-founded Spotii-in-a-Box, which was acquired by NymCard.

Two exits. Two different companies. That’s not a coincidence. That’s a pattern.

She also holds an MBA from Wharton, one of the top business schools in the world. Wharton MBAs are trained in strategy, finance, and scaling businesses globally.

Ziyaad Ahmed: The Data Science Powerhouse

Ziyaad rounds out the team with deep expertise in data science and fintech. He previously served as Managing Director of Data Science at NymCard and worked at Afterpay (one of the pioneers of buy-now-pay-later globally).

Legal tech is fundamentally about data. Teaching AI to understand legal documents requires massive datasets and sophisticated algorithms. Having someone with Ziyaad’s background means Qanooni can build genuinely smart products, not just basic automation.

He also has an MBA from Wharton, which means he and Anuscha speak the same language when it comes to business strategy.

Why This Team Combination Works

Look at what Qanooni has:

Deep legal expertise (Karim)

Proven business-building and exit experience (Anuscha)

Advanced data science and AI capability (Ziyaad)

Top-tier business education (Wharton MBAs)

This is the holy trinity of startup success: domain expertise, business savvy, and technical firepower.

Most startups have one or maybe two of these. Qanooni has all three.

Why Legal Tech Matters: The Real-World Impact

Let’s step back from the numbers and talk about why any of this actually matters.

The legal industry is one of the most expensive and time-consuming service industries in the world.

Lawyers charge hundreds of dollars per hour. Legal cases drag on for months or years. Small businesses can’t afford proper legal help. Contracts take weeks to negotiate.

Legal tech can fix these problems:

Speed

What takes a lawyer 8 hours to review manually, AI can analyze in 8 minutes. This isn’t just convenient. It’s transformative.

Imagine you’re a startup that needs to review vendor contracts. With traditional lawyers, you’d pay $2,000 and wait three days. With legal tech, you might pay $200 and get results in an hour.

Cost

When work gets faster, it gets cheaper. Legal tech makes legal services affordable for small businesses, startups, and individuals who previously couldn’t access quality legal help.

This democratizes access to justice in a meaningful way.

Accuracy

Humans make mistakes, especially when reviewing hundreds of pages of dense legal text. AI doesn’t get tired. It doesn’t miss clauses. It catches inconsistencies that human eyes might skip.

Scalability

A law firm can only hire so many lawyers. But software scales infinitely. This means firms can take on more clients without proportionally increasing their costs.

The Competitive Advantage for Early Adopters

Here’s what most people don’t realize: the law firms that adopt legal tech first will have an almost unfair advantage.

Think about it from a competitive perspective.

Firm A uses traditional methods. They need 10 lawyers to handle 100 clients. Each lawyer costs $150,000 per year in salary and benefits. Total cost: $1.5 million.

Firm B uses legal tech. The AI handles routine work, so they only need 6 lawyers to handle the same 100 clients. They pay $50,000 per year for software. Total cost: $950,000.

Firm B just saved $550,000 per year. They can either:

Keep the savings and earn higher profits

Pass savings to clients and win on price

Hire one more senior specialist lawyer and win on quality

In any scenario, Firm B wins.

And here’s the kicker: once Firm B builds its workflow around legal tech, Firm A can’t catch up easily. The learning curve is steep. The data advantage compounds over time. The reputation for being modern and efficient attracts better clients.

This is why early adoption matters so much in transformative technologies.

The GCC Advantage: Why the Gulf is Perfect for Legal Tech

The GCC has some unique advantages that make it an ideal market for legal tech innovation:

1. High Digital Adoption

The GCC has some of the highest smartphone penetration and digital adoption rates in the world. People here are comfortable with technology. They expect modern solutions.

2. Government Support for Innovation

Countries like the UAE and Saudi Arabia are heavily investing in technology and innovation. Vision 2030 in Saudi Arabia specifically calls for digital transformation across all sectors, including legal services.

3. International Business Hub

Dubai, Abu Dhabi, and Riyadh are global business centers. Companies here work with international partners, which means they need legal tech that meets global standards.

4. Language Opportunity

The GCC needs legal tech that works in both English and Arabic. Companies that solve this problem well have a significant moat and can expand across the entire Arab world.

5. Wealthy Client Base

GCC law firms serve wealthy individuals, corporations, and governments. They can afford to pay for premium legal tech solutions if those solutions deliver real value.

What Happens Next: Predictions for GCC Legal Tech

Based on global trends and what we’re seeing in the region, here’s what I predict will happen over the next 3 to 5 years:

More Competition

Those 10 new startups won’t be the last. As Clara Technology and others prove the market exists, more entrepreneurs will enter the space. Expect 20 to 30 legal tech companies in the GCC by 2027.

Consolidation

Not all 10 new startups will survive. Some will fail. Some will merge. A few will get acquired by larger players. This is normal and healthy. The best companies will emerge stronger.

Global Expansion

The successful GCC legal tech companies will expand beyond the region. They’ll enter markets in Europe, Asia, Africa, and maybe even North America. The GCC will be their base, not their limit.

Bigger Rounds

As these companies prove their models work, they’ll raise larger funding rounds. Don’t be surprised to see $10 million, $20 million, or even $50 million rounds in GCC legal tech within the next few years.

AI Integration

Every legal tech company will become an AI company. Natural language processing, machine learning, and predictive analytics will become table stakes. The companies with the best AI will win.

For Investors: Why Legal Tech in the GCC Makes Sense

If you’re an investor (angel, VC, or corporate), here’s why GCC legal tech deserves a close look:

Proven Global Demand

$200 billion in annual investment globally proves this isn’t a speculative bet. Legal tech works. The question is just who will win in each market.

Experienced Teams

Companies like Nova Doc and Qanooni have founders who’ve already built successful companies. You’re not betting on first-time founders figuring it out as they go.

Multiple Exit Paths

Legal tech companies can exit through:

Acquisition by global legal tech giants

Acquisition by large law firms or consultancies

Acquisition by big tech companies expanding into legal services

Traditional IPO (if they scale large enough)

Early Stage Opportunity

With only 10 companies in the market and most still in early stages, there’s room to invest at attractive valuations before prices get bid up.

For Law Firms: How to Think About Legal Tech Adoption

If you run or work at a law firm in the GCC, you’re probably wondering: should we adopt legal tech? And if so, when?

Here’s my advice:

Start Small

You don’t need to transform your entire firm overnight. Pick one pain point and solve it with technology.

Maybe it’s a contract review. Maybe it’s document management. Maybe it’s client communication.

Start there. Learn. Then expand.

Don’t Wait Too Long

Technology adoption follows an S-curve. Early adopters get the advantage. Late adopters play catch-up forever.

You don’t need to be first, but you definitely don’t want to be last.

Ask the Right Questions

When evaluating legal tech solutions, ask:

How much time will this actually save our lawyers?

What’s the total cost, including training and implementation?

Does it integrate with our existing systems?

How secure is our client data?

What happens if the vendor goes out of business?

Calculate ROI Honestly

Don’t buy legal tech because it sounds cool. Buy it because the math makes sense.

If a tool costs $30,000 per year but saves you 500 lawyer hours at $200 per hour, that’s $100,000 in value. Easy decision.

The Bottom Line: Legal Tech in GCC is Just Getting Started

The GCC legal tech market is at the very beginning of its journey.

Yes, the local market is small. But the best companies aren’t thinking locally. They’re building global products from a GCC base.

Yes, adoption is still low. But that’s the opportunity. Early movers will capture disproportionate value.

Yes, many startups will fail. But a few will become category leaders and generate enormous returns for founders, employees, and investors.

The fundamentals are in place:

Massive global capital is flowing into legal tech

Experienced founding teams building in the GCC

Proven need for better legal technology solutions

Government support for digital transformation

Growing ecosystem of competition and innovation

The question isn’t whether legal tech will transform the GCC legal industry. The question is just how fast it will happen and who the winners will be.

Hi Mohidul! Very interesting and in-depth analysis of GCC's LegalTech sector. I think the next big opportunities for LegalTech are AI-Native Law Firms, Domain-specific AI Agents and Cybersecurity solutions for law firms. I've written a short analyzing these opportunities for 2026. Would love to get your thoughts as a VC interested in the space!

https://harshithviswanath.substack.com/p/three-legaltech-whitespace-plays?r=4y4gfu