Free Investment Analysis Tools for Startups: 20+ Professional VC Calculators for Founders and Investors

Complete Guide to Startup Valuation, Unit Economics, and Financial Planning Tools

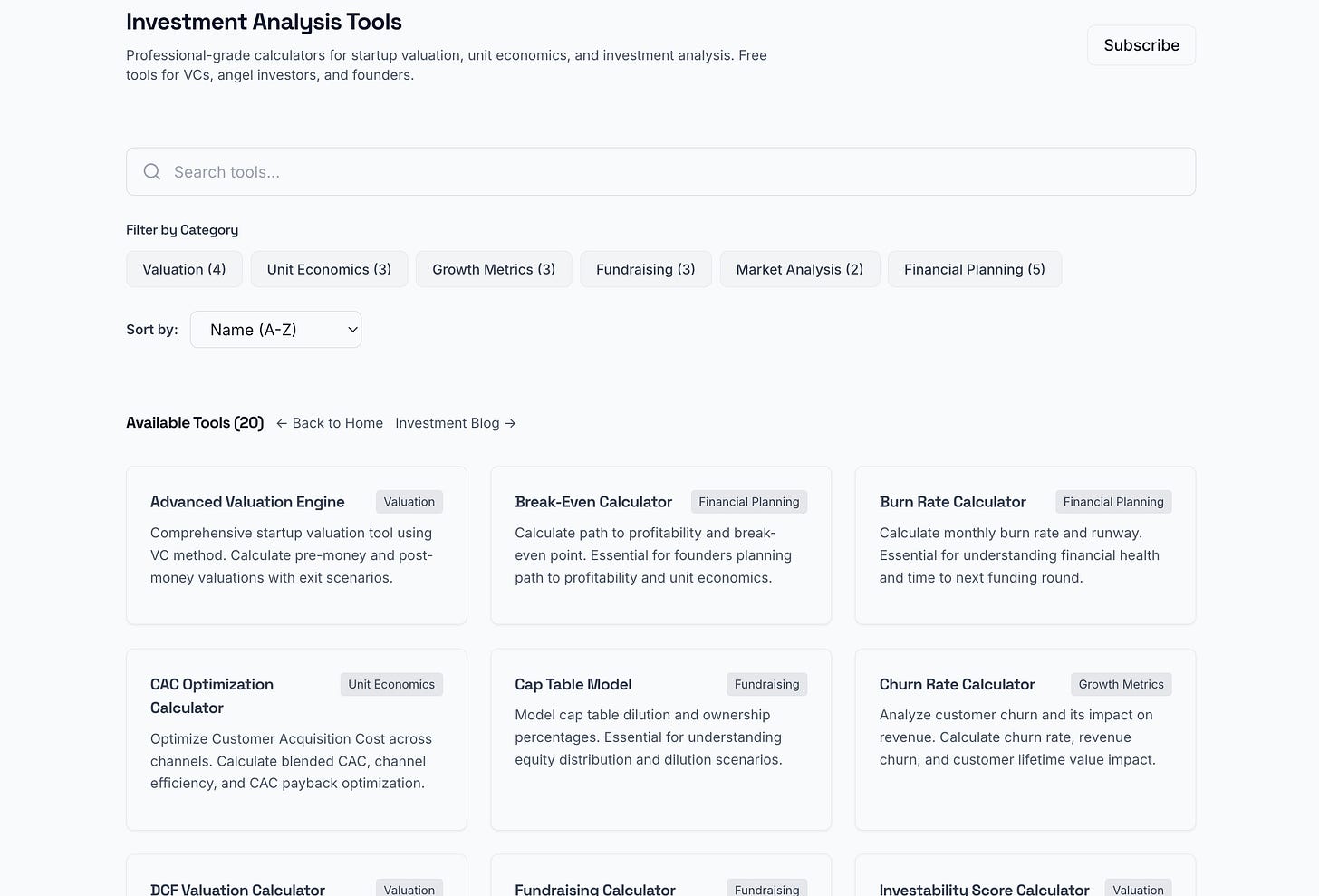

Finding reliable, free investment analysis tools can be challenging for startup founders and early-stage investors. This comprehensive guide covers 20+ professional-grade calculators designed for startup valuation, unit economics analysis, fundraising planning, and financial modeling.

Access all tools here: mohidulalam.com/tools

Table of Contents

Valuation Tools

Unit Economics Calculators

Growth Metrics Tools

Fundraising Calculators

Market Analysis Tools

Financial Planning Calculators

Valuation Tools

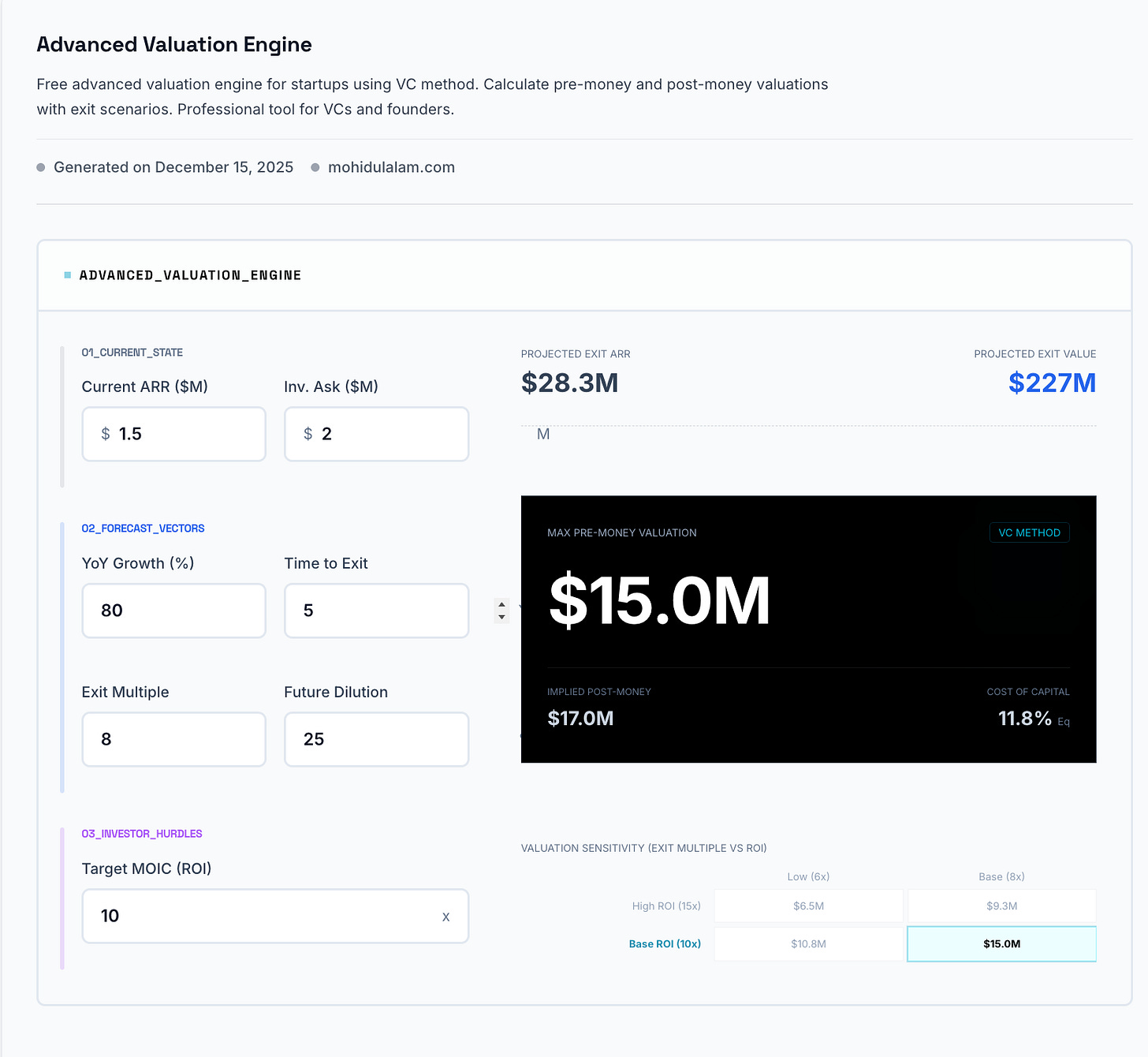

1. Advanced Valuation Engine

Keywords: startup valuation calculator, VC method valuation, pre-money valuation, post-money valuation

The Advanced Valuation Engine uses the Venture Capital method to calculate comprehensive startup valuations. This tool helps founders and investors determine:

Pre-money valuation: Company value before investment

Post-money valuation: Company value after investment

Exit scenarios: Multiple exit valuations and returns

Investor returns: Expected ROI across different scenarios

Best for: Seed to Series B startups, angel investors, VC analysts

How to use: Input your revenue projections, exit multiple assumptions, discount rate, and investment amount to generate complete valuation scenarios.

2. DCF Valuation Calculator

Keywords: DCF calculator, discounted cash flow valuation, enterprise value calculator, startup DCF model

The DCF (Discounted Cash Flow) Calculator uses fundamental financial modeling to determine enterprise value based on projected cash flows.

Key features:

Free cash flow projections

Terminal value calculations

WACC (Weighted Average Cost of Capital) modeling

Enterprise value and equity value outputs

Best for: Growth-stage startups, financial analysts, investors evaluating mature companies

How to use: Enter 5-year revenue projections, operating margins, capital expenditure assumptions, and discount rate to calculate present value.

3. IRR Calculator (Internal Rate of Return)

Keywords: IRR calculator, internal rate of return calculator, investment return calculator, venture capital IRR

Calculate the Internal Rate of Return for investments with multiple cash flows over time. Essential for comparing investment opportunities and measuring portfolio performance.

What it calculates:

IRR percentage for any investment

Multiple cash flow scenarios

Time-weighted returns

Comparison metrics across investments

Best for: Angel investors, VC funds, portfolio managers

How to use: Input initial investment amount and all subsequent cash flows (additional investments and exits) with dates to calculate IRR.

4. Investability Score Calculator

Keywords: startup evaluation tool, investment scoring system, startup assessment framework

Score and evaluate startups across four critical dimensions:

Team Assessment (0-25 points): Founder experience, domain expertise, execution ability

Market Opportunity (0-25 points): Market size, growth rate, timing

Product-Market Fit (0-25 points): Customer validation, retention, NPS

Competitive Moat (0-25 points): Defensibility, network effects, switching costs

Total Score: 0-100 (70+ typically indicates strong investability)

Best for: Pre-seed to Series A evaluation, angel investor screening, VC deal flow assessment

Unit Economics Calculators

5. LTV/CAC Calculator

Keywords: LTV CAC calculator, lifetime value calculator, customer acquisition cost calculator, SaaS metrics calculator

The LTV/CAC ratio is the most important metric for evaluating sustainable growth. This calculator determines:

LTV (Lifetime Value): Total revenue per customer over their lifetime

CAC (Customer Acquisition Cost): Total cost to acquire one customer

LTV:CAC Ratio: Industry benchmark is 3:1 or higher

Payback Period: Time to recover CAC (target: <12 months)

Formula: LTV = (ARPU × Gross Margin%) / Churn Rate

Best for: SaaS companies, subscription businesses, marketplace platforms

How to use: Input monthly ARPU, gross margin percentage, monthly churn rate, and total sales & marketing expenses to calculate your LTV:CAC ratio.

6. Unit Economics Calculator

Keywords: unit economics calculator, contribution margin calculator, unit profitability calculator

Comprehensive unit economics analysis including:

Contribution Margin: Revenue minus variable costs per unit

Contribution Margin %: (Revenue - Variable Costs) / Revenue

Payback Period: Months to recover CAC from contribution margin

Break-even Volume: Units needed to cover fixed costs

Best for: SaaS startups, e-commerce businesses, marketplace platforms

How to use: Enter price per unit, variable cost per unit, fixed costs, and CAC to analyze unit-level profitability.

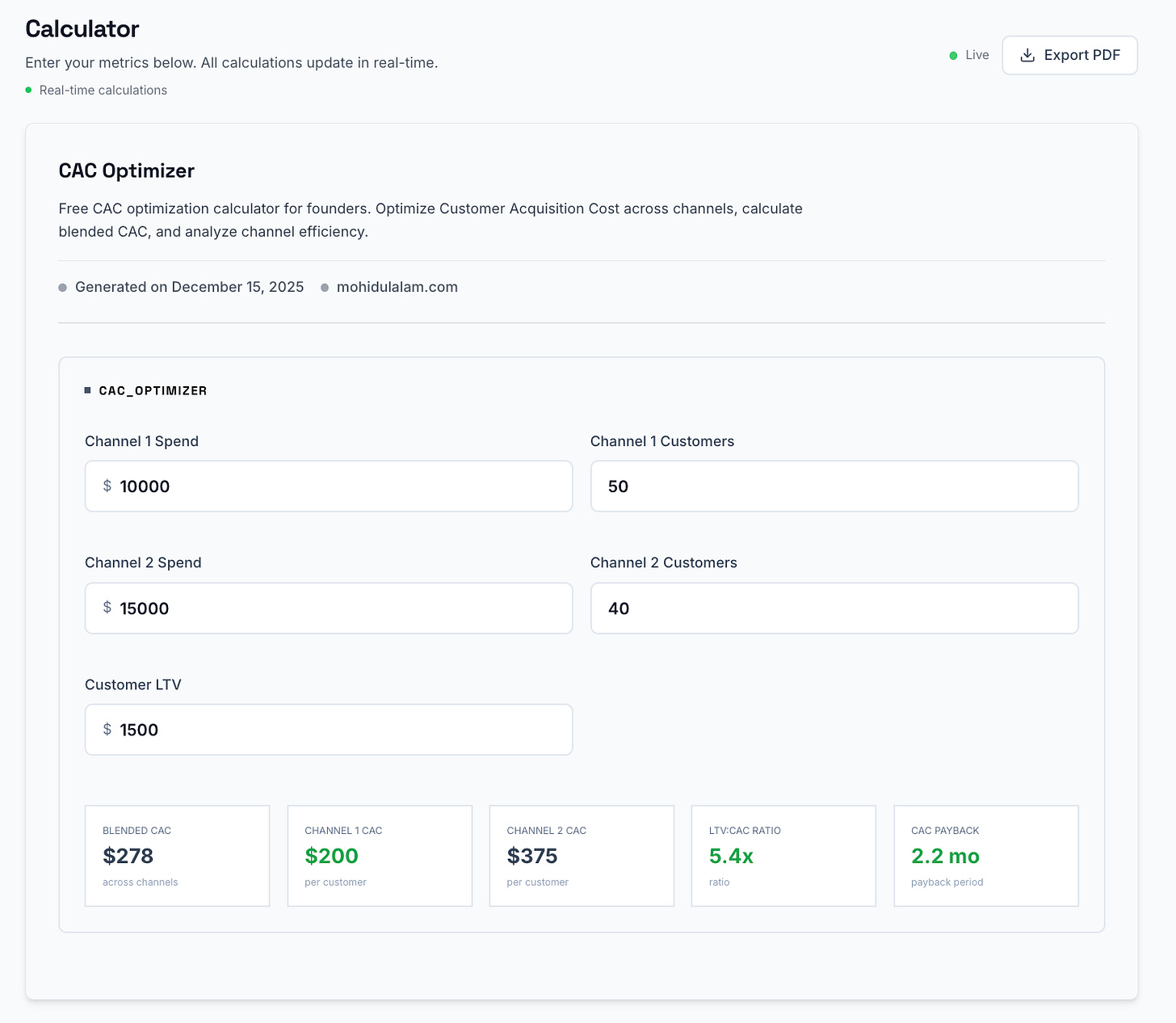

7. CAC Optimization Calculator

Keywords: CAC optimizer, customer acquisition cost optimization, marketing channel ROI calculator

Optimize Customer Acquisition Cost across multiple channels by analyzing:

Blended CAC: Average CAC across all channels

Channel-specific CAC: Cost per customer by channel

Channel efficiency: ROI and payback by channel

Budget allocation: Optimal spend distribution

Best for: Growth teams, marketing managers, performance marketers

How to use: Input spend and conversions by channel (paid search, social, content, etc.) to identify most efficient acquisition channels.

Growth Metrics Tools

8. Churn Rate Calculator

Keywords: churn rate calculator, customer churn calculator, revenue churn calculator, retention rate calculator

Calculate and analyze customer churn impact:

Customer Churn Rate: % customers lost per period

Revenue Churn Rate: % revenue lost from churn

Net Revenue Retention: Including expansion revenue

LTV Impact: How churn affects lifetime value

Formula: Churn Rate = (Customers Lost / Starting Customers) × 100

Best for: SaaS companies, subscription businesses

How to use: Input starting customers, customers lost, starting MRR, churned MRR, and expansion MRR to calculate comprehensive churn metrics.

9. MRR Growth Calculator

Keywords: MRR calculator, monthly recurring revenue calculator, SaaS revenue calculator, ARR calculator

Track Monthly Recurring Revenue growth components:

New MRR: Revenue from new customers

Expansion MRR: Upsells and upgrades

Contraction MRR: Downgrades

Churned MRR: Lost customers

Net New MRR: Total monthly growth

Formula: Net New MRR = New MRR + Expansion MRR - Contraction MRR - Churned MRR

Best for: SaaS startups, subscription services

10. Revenue Growth Calculator

Keywords: revenue growth calculator, CAGR calculator, compound annual growth rate calculator, growth rate calculator

Calculate revenue growth rates:

CAGR (Compound Annual Growth Rate): Annualized growth rate

Monthly Growth Rate: Month-over-month growth

Revenue Projections: Future revenue based on growth rate

Growth Requirements: Rate needed to hit targets

Formula: CAGR = (Ending Value / Beginning Value)^(1/Years) - 1

Best for: All startups, growth planning, investor presentations

Fundraising Calculators

11. Cap Table Model

Keywords: cap table calculator, equity dilution calculator, startup cap table, ownership calculator

Model capitalization table across multiple rounds:

Ownership Percentages: Founder and investor stakes

Dilution Analysis: How equity changes across rounds

Option Pool Impact: Effect of employee options

Fully Diluted Shares: Complete ownership structure

Best for: Pre-seed to Series B companies, founders planning rounds

How to use: Input founder shares, investor terms, option pool size, and round details to model dilution scenarios.

12. Fundraising Calculator

Keywords: fundraising calculator, startup fundraising planning, dilution calculator, runway calculator

Plan fundraising rounds by calculating:

Amount to Raise: Based on runway needs

Dilution Impact: Ownership percentage given up

Runway Extension: Months of operation funded

Valuation Scenarios: Pre and post-money valuations

Best for: Founders planning seed to Series A rounds

How to use: Input current burn rate, desired runway, current valuation, and investment amount to see dilution and runway impact.

13. Liquidation Waterfall Calculator

Keywords: liquidation preference calculator, waterfall analysis, exit distribution calculator, preference stack calculator

Calculate how exit proceeds are distributed:

Liquidation Preferences: Investor preferences (1x, 2x, etc.)

Participation Rights: Participating vs non-participating preferred

Distribution Waterfall: Who gets paid in what order

Founder Take-Home: Net proceeds to founders

Best for: Understanding exit scenarios, negotiating term sheets

How to use: Input exit value, investor amounts, preferences, and participation terms to see distribution across stakeholders.

Market Analysis Tools

14. Market Size Calculator (TAM SAM SOM)

Keywords: TAM calculator, SAM calculator, SOM calculator, market size calculator, addressable market calculator

Calculate three levels of market opportunity:

TAM (Total Addressable Market): Total market demand

SAM (Serviceable Addressable Market): Market you can reach

SOM (Serviceable Obtainable Market): Market you can capture

Calculation Methods:

Top-down: Industry reports and market research

Bottom-up: Customer segments × average revenue

Value theory: Problem value × affected population

Best for: Pitch decks, market opportunity assessment, strategic planning

15. Product-Market Fit Score

Keywords: product market fit calculator, PMF score, Sean Ellis test, startup validation tool

Measure product-market fit using:

Sean Ellis Test: “Very disappointed” threshold (>40% = PMF)

Retention Cohorts: Customer retention over time

NPS (Net Promoter Score): Customer satisfaction

Engagement Metrics: Usage frequency and depth

Best for: Pre-seed to Series A startups validating PMF

Financial Planning Calculators

16. Burn Rate Calculator

Keywords: burn rate calculator, cash burn calculator, runway calculator, startup burn rate

Calculate monthly cash burn and runway:

Gross Burn Rate: Total monthly expenses

Net Burn Rate: Monthly expenses minus revenue

Cash Runway: Months until cash runs out

Funding Needs: When to start raising next round

Formula: Net Burn Rate = Monthly Expenses - Monthly Revenue

Best for: All startups, financial planning, board reporting

17. Runway Calculator

Keywords: cash runway calculator, startup runway, months of runway calculator

Calculate remaining operational time:

Current Runway: Months of operation with current cash

Runway with New Funding: Extended runway post-raise

Break-even Timeline: Path to profitability

Fundraising Timeline: When to start raising (typically 6+ months before runway ends)

Formula: Runway (months) = Current Cash / Monthly Net Burn

Best for: CFO planning, fundraising timing, board meetings

18. Break-Even Calculator

Keywords: break even calculator, break even analysis, path to profitability calculator, breakeven point calculator

Calculate path to profitability:

Break-even Point: Units/customers needed to cover costs

Break-even Timeline: Months to profitability

Contribution Margin: Profit per unit after variable costs

Scenarios: Impact of pricing and cost changes

Formula: Break-even Units = Fixed Costs / (Price - Variable Cost per Unit)

Best for: Founders planning profitability, financial modeling

19. Pricing Strategy Calculator

Keywords: pricing calculator, SaaS pricing calculator, pricing strategy tool, optimal price calculator

Optimize pricing based on:

Cost-Plus Pricing: Cost × desired margin

Value-Based Pricing: Customer willingness to pay

Competitive Pricing: Market positioning

Price Sensitivity: Impact of price changes on volume

Best for: SaaS companies, subscription businesses, product launches

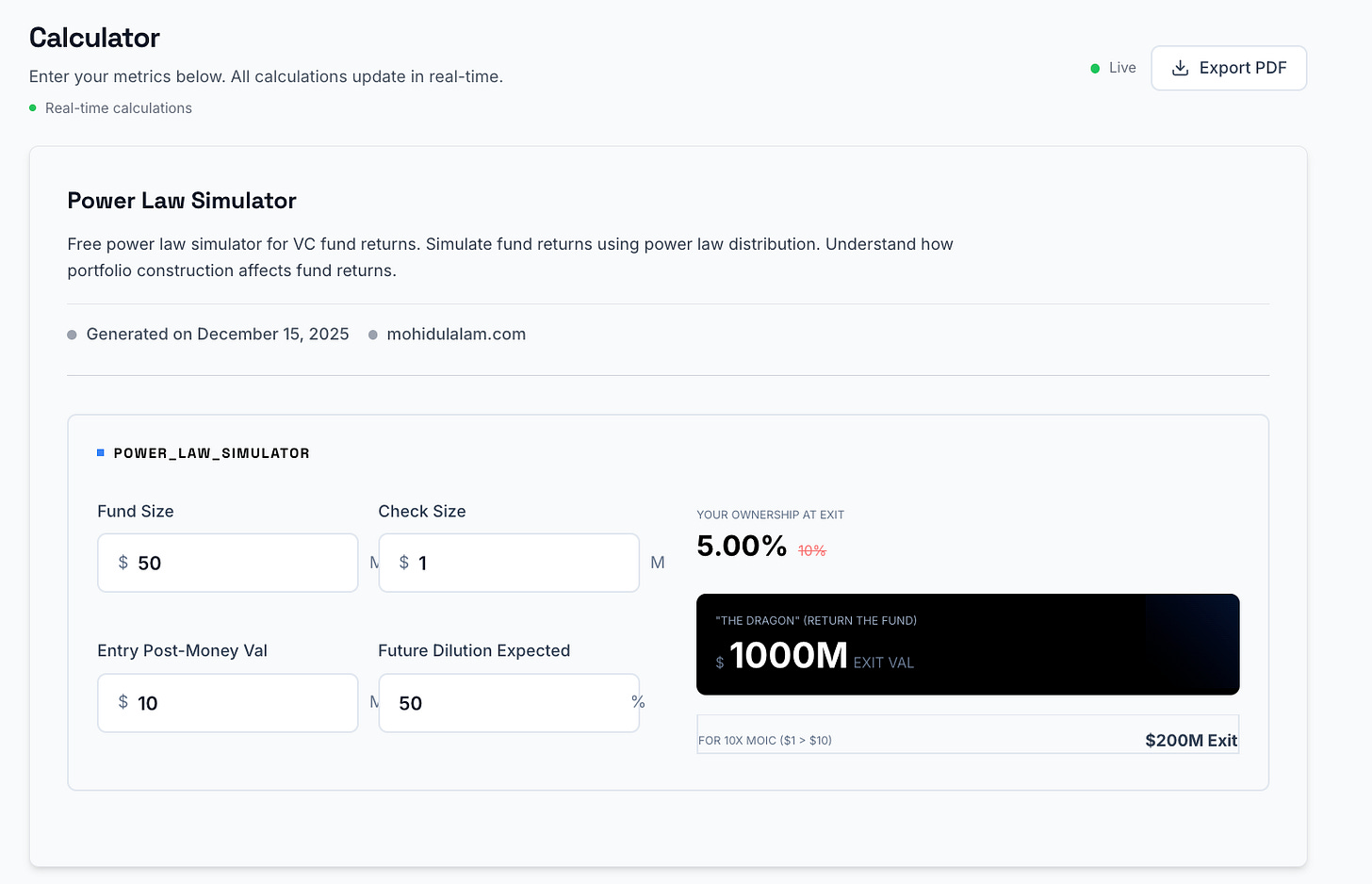

20. Power Law Simulator

Keywords: power law calculator, VC returns simulator, portfolio returns calculator, venture capital portfolio

Simulate fund returns using power law distribution:

Portfolio Construction: Number of investments and check sizes

Return Distribution: How winners drive fund returns

Fund Outcomes: Expected fund IRR and MOIC

Winner Impact: How top performers affect overall returns

Key Insight: In VC, top 10% of investments typically generate 90% of returns

Best for: VC fund managers, portfolio construction, LP presentations

How to Use These Tools Effectively

For Founders:

Start with Unit Economics: Understand LTV/CAC before scaling

Model Your Runway: Use burn rate and runway calculators monthly

Plan Fundraising Early: Use cap table and fundraising calculators 6+ months before you need capital

Validate Market Size: Calculate realistic TAM/SAM/SOM for pitch decks

Track Growth Metrics: Monitor MRR, churn, and growth rates consistently

For Investors:

Due Diligence: Use DCF and IRR calculators for valuation analysis

Quick Screening: Apply investability score for initial assessment

Portfolio Management: Track power law distribution across investments

Term Sheet Modeling: Use liquidation waterfall before signing deals

Performance Tracking: Monitor portfolio company metrics monthly

For Operators:

Financial Planning: Model burn rate, runway, and break-even monthly

Growth Optimization: Use CAC optimizer and churn calculator

Pricing Strategy: Test pricing scenarios before launches

Board Reporting: Generate consistent metrics using these tools

Team Alignment: Share models with leadership team

Key Features Across All Tools

✓ Free Forever: No paywalls, no subscriptions, no credit card required

Privacy-First: All calculations run in your browser, no data stored

Professional-Grade: Used by founders, VCs, and operators across MENA and globally

Educational: Each tool includes methodology and industry benchmarks

Real-Time: Instant calculations as you adjust inputs

Export-Ready: Download results as PDF for presentations

Mobile-Optimized: Works on all devices

Common Use Cases by Stage

Pre-Seed Startups

Product-Market Fit Score

Unit Economics Calculator

Break-Even Calculator

Market Size Calculator

Seed Stage

Fundraising Calculator

Cap Table Model

Burn Rate Calculator

LTV/CAC Calculator

Series A

DCF Valuation Calculator

Advanced Valuation Engine

MRR Growth Calculator

Liquidation Waterfall

Growth Stage

Power Law Simulator

CAC Optimization

Revenue Growth Calculator

Pricing Strategy Calculator

Industry Benchmarks and Best Practices

SaaS Metrics Benchmarks:

LTV:CAC Ratio: 3:1 or higher (excellent: 5:1+)

CAC Payback Period: <12 months (best-in-class: <6 months)

Monthly Churn: <3% (annual <36%)

Net Revenue Retention: >100% (best-in-class: >120%)

Gross Margin: >70% (world-class: >80%)

Fundraising Benchmarks:

Pre-Seed: $500K-$1.5M at $3M-$8M valuation

Seed: $2M-$5M at $8M-$20M valuation

Series A: $5M-$15M at $20M-$50M valuation

Typical Dilution: 15-25% per round

Financial Health Metrics:

Runway: 18+ months (start raising at 6-9 months)

Burn Multiple: <1.5x (revenue growth / net burn)

Rule of 40: Growth Rate% + Profit Margin% ≥ 40%

Frequently Asked Questions

Q: Are these tools really free?

A: Yes, completely free. No hidden costs, no trials, no upsells.

Q: Do I need to create an account?

A: No. All tools work immediately without signup.

Q: Is my data private?

A: Yes. All calculations run locally in your browser. Nothing is stored or transmitted.

Q: Can I use these for investor presentations?

A: Yes. All tools support PDF export for pitch decks and board meetings.

Q: Which tool should I start with?

A: Founders: Start with Unit Economics and Burn Rate. Investors: Start with IRR and Valuation Engine.

Q: Are these suitable for non-SaaS businesses?

A: Yes. While optimized for SaaS, most tools work for any startup model.

Q: How often are tools updated?

A: Continuously. Feedback drives improvements and new features.

About the Creator

Mohidul Alam is a venture capital investor with experience as a startup founder, operator at Antler, and investor at VentureSouq. Based in Abu Dhabi, UAE, he focuses on early-stage investments in FinTech, AI SaaS, and marketplace businesses across MENA and globally.

Connect:

Website: mohidulalam.com

LinkedIn: linkedin.com/in/mdmohidul

Twitter: @MohidulAlamX

Access All Tools

🔗 Start using all 20+ investment calculators: mohidulalam.com/tools

Bookmark this page and share it with founders and investors who need professional-grade financial analysis tools.

Related Resources

Investment Blog: Deep dives on FinTech, AI SaaS, and startup investing at mohidulalam.com/blog

Investment Theses: Sector-specific investment frameworks and analysis

Newsletter: Subscribe at The Analytical Investor

Keywords for Search: startup calculator, VC calculator, investment analysis tools, startup valuation calculator, SaaS metrics calculator, burn rate calculator, runway calculator, LTV CAC calculator, IRR calculator, DCF calculator, cap table calculator, fundraising calculator, unit economics calculator, churn calculator, MRR calculator, market size calculator, break even calculator, pricing calculator, free startup tools, free investment tools, founder tools, investor tools, financial modeling tools, startup financial planning, venture capital tools, angel investor tools, early stage startup tools, MENA startup tools, Abu Dhabi startup tools, UAE startup tools

Last Updated: December 2025